Key Takeaway: Automating your teacher payroll is crucial for scaling a tutoring business. Switching from manual spreadsheets to an integrated system saves up to 60% of administrative time, eliminates costly payment errors, and provides the flexibility to attract top teaching talent with diverse pay models.

Accurate payroll starts with accurate timekeeping. You cannot pay people correctly if you do not know exactly when they worked. This is where a solid attendance system becomes essential. We cover how to master this in our guide to attendance tracking for your tutoring center. The goal is to create a seamless flow from the moment a lesson ends to the second money hits your tutor's bank account.

Why is Manual Payroll Slowing Your Growth?

If you still run teacher payroll on a spreadsheet, you actively put the brakes on your tutoring business's growth. That manual process is a silent killer of potential. It eats up dozens of hours every month that you should spend on finding new students or improving your curriculum.

A spreadsheet seems simple at first. But as you add tutors, students, and different pay rates, that sheet becomes a tangled mess. This administrative drain, coupled with the ever-present risk of human error, is what keeps many great tutoring businesses from scaling up.

What Are the Hidden Costs of Manual Calculations?

Every pay period turns into a marathon of manual data entry. You painstakingly cross-reference attendance logs with individual teacher contracts. Think about it. You might spend ten hours every two weeks just on payroll, juggling different rates for various session types. That's 20 hours per month on one task.

This process is not just slow; it is incredibly fragile. One tiny copy-paste error or a misread attendance log can cascade into much bigger problems. You can explore more efficient methods in this ultimate guide to streamlining your payroll process efficiently.

How Do Payroll Errors Impact Your Business?

Manual data entry is a recipe for mistakes. These are not just minor typos. They have real financial and relational consequences that can sting your tutoring center. Even small, repeated errors add up, chipping away at your bottom line and eroding the trust you've built with your tutors.

Overpayments: Paying a tutor for a session they missed or cancelled comes directly out of your profit. You will find these mistakes are tough to spot and even more awkward to fix without damaging relationships.

Underpayments: This is one of the fastest ways to lose a great tutor. Nothing sours a working relationship quicker than feeling undervalued. It kills morale, leads to higher turnover, and leaves you with the cost of finding and training new staff.

Frustrated Tutors: When your best teachers have to spend their own time double-checking your math, it creates friction. They want to focus on teaching, not auditing their paychecks. Consistent, accurate payroll is a non-negotiable part of tutor retention.

The Growing Compliance Burden

Mismanaging payroll goes way beyond simple payment errors and opens your business to serious compliance risks. The distinction between employees (W-2) and independent contractors (1099) is critical. Getting it wrong can lead to significant penalties. Manually calculating tax withholdings is a complex task.

And the industry is growing. The global private tutoring market hit $97.11 billion in 2023, a 6% increase from the year before. To capture that demand, you need systems that can scale. You can explore more tutoring statistics on consumeraffairs.com to see how fast the market is expanding.

Building a Flexible Tutor Compensation Framework

Getting your tutor pay structure right is one of the most important things you will do for your tutoring business. A rigid, one-size-fits-all approach no longer works. You need a flexible system that rewards performance, experience, and willingness to take on high-demand classes.

The best educators, especially those tutoring as a side hustle, want their expertise valued. They look for fair, competitive pay and some control over their schedule. A well-designed compensation framework is your best tool for recruiting and retaining that top-tier talent.

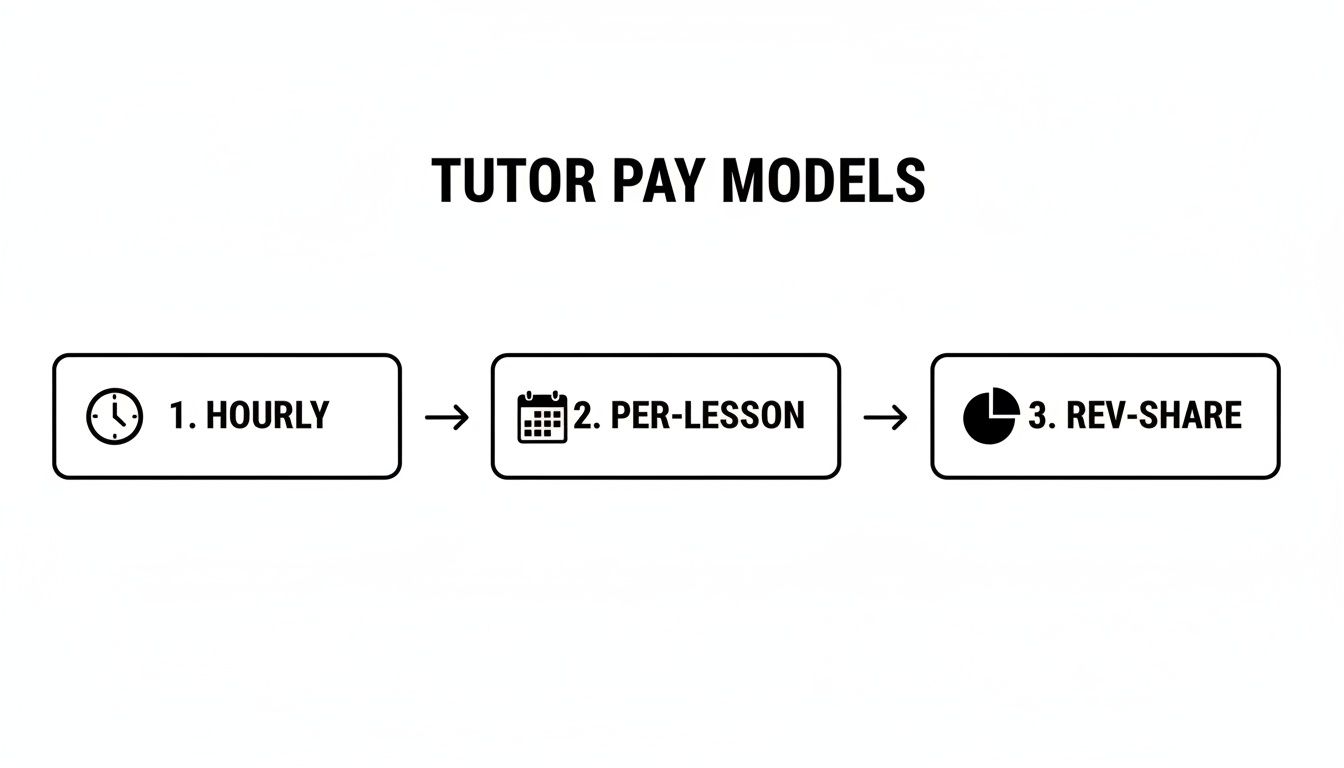

What Are the Most Common Tutor Pay Models?

First, you need to decide how you will pay your tutors. Every model has its pros and cons. The right choice depends on your business goals, session types, and the kind of tutors you want to hire.

Hourly Rate: The classic model. Tutors get a fixed amount for every hour they teach. It’s straightforward, easy to track, and simple for everyone to understand.

Per-Lesson Fee: You pay a flat rate for each lesson completed, no matter the exact duration. This works great for standardized programs like test prep courses where lesson lengths are consistent.

Revenue Share: Tutors earn a percentage of the revenue from their own lessons. This model is powerful because it turns tutors into partners. When the business does well, they do well.

Setting Tiered Rates and Premiums

A single, flat pay rate is a missed opportunity. It does not account for different levels of effort, demand, or skill. A flexible system uses tiers and premiums to make sure your pay is fair and motivating. This is how you reward your best tutors for taking on trickier subjects or less convenient times.

For instance, you might have different pay scales for one-on-one versus group sessions. A tutor could earn $30 per hour for an individual lesson but jump to $45 per hour for a group of five students. This acknowledges the extra prep and classroom management involved.

How Do I Implement Pay Premiums?

Premiums are your secret weapon for filling hard-to-staff slots. They are bonuses you add for lessons that fall outside your normal schedule. This lets you meet client demand without making tutors feel forced into working undesirable hours.

Here are a few common scenarios where premiums make a difference:

Weekend or Evening Hours: Offer a 10-15% pay bump for lessons scheduled after 6 PM on weekdays or anytime on Saturdays and Sundays.

Specialized Subjects: Pay a higher rate for advanced subjects like AP Calculus or SAT/ACT prep compared to standard K-8 math tutoring.

Last-Minute Bookings: Add a small bonus for tutors who pick up a lesson with less than 24 hours' notice.

Comparison Table: Tutor Compensation Models

Choosing the right compensation model means balancing business needs with what motivates your tutors. There is no single "best" answer. Many successful tutoring companies use a hybrid approach, applying different pay structures to different types of services.

Compensation Model | How It Works | Best For | Pros | Cons |

|---|---|---|---|---|

Hourly Rate | Tutors paid a fixed rate per hour. | Consistent 1-on-1 tutoring, homework help. | Simple to calculate and understand. Predictable costs. | Doesn't reward efficiency or larger class sizes. |

Per-Lesson Fee | Tutors paid a flat fee per session. | Standardized group classes, test prep courses. | Predictable payroll. Easy to budget for programs. | Less flexible for lessons that run over time. |

Revenue Share | Tutors earn a percentage (e.g., 40%) of lesson revenue. | High-value specialty tutoring, businesses with variable pricing. | Aligns tutor pay with business success. Motivates tutors. | Can lead to variable income for tutors. More complex to calculate. |

Base + Variable | A fixed base salary plus bonuses for performance. | Full-time or lead tutors, center managers. | Provides income stability. Rewards key metrics. | Higher fixed cost. Requires clear performance tracking. |

Ultimately, the goal is to create a structure that feels fair, transparent, and motivating for your team while keeping your business financially healthy.

From Attendance to Payout: How to Automate Your Payroll

You can automate your payroll workflow. By linking tutor attendance directly to client invoicing and then to payroll, you can build a hands-off system. You get to ditch manual data entry, eliminate costly errors, and reclaim hours of admin time. Most importantly, your tutors get paid accurately and on time, every single time.

It all starts when a tutor marks a lesson as complete. That single click kicks off a chain reaction in your management software. It connects the service you delivered directly to your finances.

Whether you use hourly rates, per-lesson fees, or a revenue-share model, the calculation rules can be set up once and then automated completely.

Connecting Attendance to Invoicing

The moment a tutor marks attendance, the system should automatically generate the client's invoice. The software already knows the rate for that session and pulls it in instantly. This ensures you bill families accurately and right away, which improves your cash flow.

Forget spending the end of the month manually creating invoices. The system does it in real-time, which means no more missed billings. It also gives clients a transparent, up-to-the-minute record of their sessions, which goes a long way in building trust.

How does automatic payroll calculation work?

At the same time the system creates the invoice, that same attendance record calculates what you owe your tutor. The system looks at the tutor’s profile, which you have already configured with their specific pay model, and applies the correct rate.

For Hourly Tutors: The system logs the lesson duration and multiplies it by their hourly rate.

For Per-Lesson Tutors: It logs the completed session and credits their account with the pre-set flat fee.

For Revenue-Share Tutors: The software calculates their percentage of the lesson fee and adds it to their running total.

This happens immediately, so you always have a real-time view of your payroll liabilities. For a deeper dive into software that handles this, check out our complete guide to tutor payroll software to see how different platforms stack up.

Accumulating Payouts Over a Payroll Period

Each of these small calculations builds up automatically throughout your payroll period. It does not matter if you pay weekly, bi-weekly, or monthly. The system keeps a running tab for every tutor on your team. It can even handle special cases, like applying a 15% bonus for lessons taught on a weekend.

This automated accumulation is where you truly start to see the time savings. Instead of sitting down with a spreadsheet and a calculator at the end of the month, the system does all the heavy lifting for you day by day.

Generating the Final Payout Statement

When the payroll period ends, the process generates a final payout statement for each tutor. This is a detailed report breaking down every lesson taught, the rate for each one, and the grand total earned. It gives your tutors total transparency, answering their questions before they even ask.

Your job is reduced to a quick final review. You scan the summary, and with one click, you can approve the payouts. What used to be a multi-day administrative nightmare becomes a task that takes just a few minutes. This kind of automation professionalizes your entire operation.

Navigating Tutor Taxes and Compliance

Correctly classifying your tutors as either employees or independent contractors is one of the most critical decisions you will make. This is not just a box you tick. It dictates your tax, withholding, and reporting duties. Getting this wrong can lead to audits, back taxes, and hefty penalties.

What Is the Difference Between Employees and Contractors?

The real difference between an employee and a contractor boils down to control. An employee (who gets a W-2 form in the U.S.) is someone you direct closely, controlling how, when, and where they do their work. An independent contractor (who gets a 1099-NEC form) is a self-employed professional you hire for a specific service.

Your Responsibilities for W-2 Employees

When you bring on a tutor as an employee, your payroll responsibilities are much more involved. You must manage withholdings for taxes and contribute on their behalf.

Here is a quick rundown of your main obligations:

Tax Withholding: You must calculate and deduct the right amounts for federal and state income taxes, plus Social Security and Medicare (FICA) taxes from each paycheck.

Employer Taxes: You are also responsible for paying the employer's share of Social Security and Medicare, along with federal and state unemployment taxes.

W-2 Forms: At year-end, you must provide each employee with a Form W-2 that details their total earnings and all the taxes withheld.

Your Responsibilities for 1099 Contractors

Working with independent contractors simplifies the payroll process. They are considered self-employed and are responsible for handling their own tax obligations. This is a very common and scalable model for tutoring businesses.

Your duties for contractors are much lighter:

Clear Contracts: You absolutely need a signed agreement. It should clearly define the scope of work, payment terms, and explicitly state their status as an independent contractor.

No Tax Withholding: You do not take any taxes out of their pay. You pay them their full, negotiated rate for the services they provide.

1099-NEC Forms: If you pay any single contractor $600 or more in a calendar year, you are required to issue them a Form 1099-NEC by January 31 of the following year.

How can I simplify payments for contractors?

One of the biggest administrative headaches for contractors is manually creating and submitting invoices. A modern tutoring management system eliminates this with a feature called self-billing invoices. A self-billing invoice is a compliant arrangement where your system generates invoices on behalf of your contractors, based on the lessons they have taught.

This takes the invoicing burden off your tutors. It guarantees that you receive accurate, consistently formatted invoices for your records. This makes your reconciliation and payment runs dramatically faster and more reliable.

Ready to automate your payroll and compliance? Tutorbase simplifies everything from contractor payments to payout statements.

Pulling It All Together: Finalizing Payroll

The last piece of the puzzle is reconciliation. This is where you balance your payroll data against lesson records and financial reports. What used to be an hours-long task becomes a quick, five-minute check when you have all the data in one centralized dashboard.

This final review is your safety net against costly mistakes. You can instantly spot discrepancies, like a mismatch between a tutor’s recorded hours and the invoices generated for their clients. With an integrated system, this is not a manual audit, it is a simple validation step.

How to Create a Rock-Solid Payroll Schedule

Nothing builds trust with your team like a consistent, clearly communicated payroll schedule. Whether you pay weekly, bi-weekly, or monthly, your tutors will appreciate knowing exactly when their money is coming. This practice kills uncertainty and cuts down on "When do I get paid?" emails.

A predictable schedule is also a huge help for your own financial planning. You can manage your cash flow much more effectively when you know precisely when your largest operational expense will hit.

Can I use payroll data to make smarter decisions?

Yes, your payroll data is a goldmine of business intelligence. You absolutely need to generate reports that analyze your payroll costs as a percentage of total revenue. This is one of the most important metrics for understanding your profitability and making smart calls on pricing and staffing.

A powerful payroll system can slash administrative time spent on reconciliation and reporting by up to 60%. That is time you can pour back into high-value work like marketing, curriculum development, and training your team. You also want to sync this data with your accounting software to keep a single, reliable source of financial truth.

Frequently Asked Questions (FAQ)

How long does it take to set up an automated teacher payroll system?

For most tutoring businesses, you can complete the entire setup in just a couple of days. The longest part is often organizing your existing tutor data into a clean file for import. A platform like Tutorbase can then get you fully operational in under a week.

Can a system handle my unique and complex tutor pay rates?

Yes, modern payroll software is built to handle multiple pay structures simultaneously. You can easily automate payments for tiered hourly rates, per-lesson fees, revenue-share percentages, and special pay premiums for weekend or high-demand subject lessons.

What if I pay some tutors as W-2 employees and others as 1099 contractors?

This is a very common setup that quality systems handle easily. You simply classify each tutor in their profile. The system then applies the correct rules, helping with tax withholdings for employees and generating self-billing invoices for contractors to simplify 1099 reporting.

How does automated payroll improve accuracy so much?

Automation improves accuracy by eliminating manual data entry. Since a tutor's pay calculates directly from their logged attendance, the chance of human error nearly disappears. By 2026, businesses using end-to-end automation are expected to see payroll error rates fall by over 80% compared to those using spreadsheets.

Is a new payroll system difficult for my tutors to learn?

Not at all, as the best platforms are designed with tutors in mind. The interface is clean and intuitive. For a tutor, the process is as simple as marking attendance for their lessons on a phone or computer. They also get a personal dashboard to see their schedule and track earnings in real-time.

Can I make manual adjustments to payroll if needed?

Of course. You always remain in control. While the system automates routine calculations, you can easily step in to make manual adjustments before finalizing a pay run. This is perfect for adding a one-time bonus, correcting a rare attendance error, or accommodating a special request.

How does this system help with financial reporting?

Automated systems include powerful reporting tools that give you a clear view of your finances. You can instantly generate reports on total payroll costs, analyze labor costs as a percentage of revenue, and track earnings for every tutor. This data is invaluable for making smarter decisions about pricing and profitability.

Ready to eliminate payroll errors and slash your administrative workload by up to 60%? Tutorbase automates your entire workflow from attendance to payout, so you can focus on what matters most: growing your business. Get started at tutorbase.com/register.