The Top 10 Payment Gateways for Tutoring Centers in 2026: A Complete Guide

Published: January 11, 2026 by Amy Ashford

Key Takeaway: Choosing the right payment gateway automates your cash flow, reduces admin time by up to 60%, and improves the parent experience. Stripe offers the best flexibility for integration with tutoring management software like Tutorbase, while options like Square and PayPal provide simple setups for new centers.

Choosing the right payment gateway is about more than just collecting tuition. It is about automating your cash flow, reducing administrative hours, and improving the parent experience. Many tutoring centers lose money not from a lack of students, but from manual invoicing, chasing late payments, and using fragmented tools that do not talk to each other. An inefficient payment process consumes 10+ hours per week that owners could spend on student retention and marketing.

This guide breaks down the top 10 payment gateways for tutoring centers, evaluating them on features that actually matter for your business. We analyze each option for its suitability for different center sizes, from a solo tutor building a team to a multi-location language academy. While broader lists of the 12 best payment gateways for small business in 2025 provide a great market overview, our focus is tailored specifically to the unique billing needs of educational businesses, such as prepaid credits and complex payroll.

You will find a detailed, actionable comparison covering everything from transaction fees and recurring subscription support to integration with tutoring management software like Tutorbase. Each entry includes screenshots and direct links, so you can stop wrestling with payments and focus on teaching. We explore how each platform handles critical tasks like payment reconciliation, dispute management, and payout timing, helping you find the perfect fit.

What is a Payment Gateway?

A payment gateway is a service that securely authorizes and processes credit card or direct bank payments for online and in-person transactions. It acts as the bridge between your tutoring center's website or management software and the bank networks, ensuring parents' payment information is encrypted and transactions are handled safely.

Why do tutoring centers need a payment gateway?

Tutoring centers need a payment gateway to stop wasting time on manual admin tasks. Instead of creating paper invoices, chasing checks, or running cards one by one, a gateway automates the entire process. This reduces booking errors, ensures consistent cash flow, and provides parents with a professional, convenient way to pay for lessons.

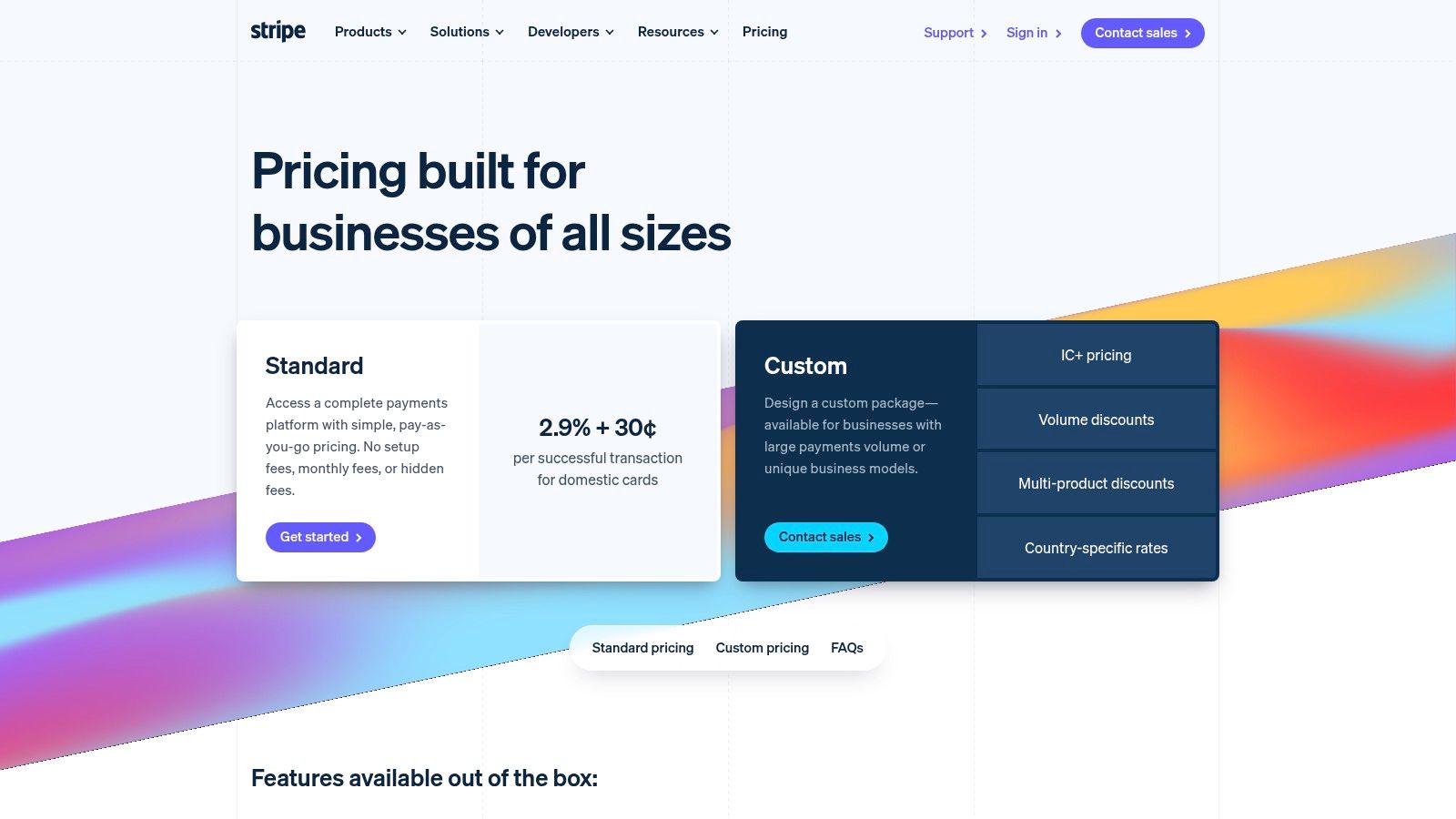

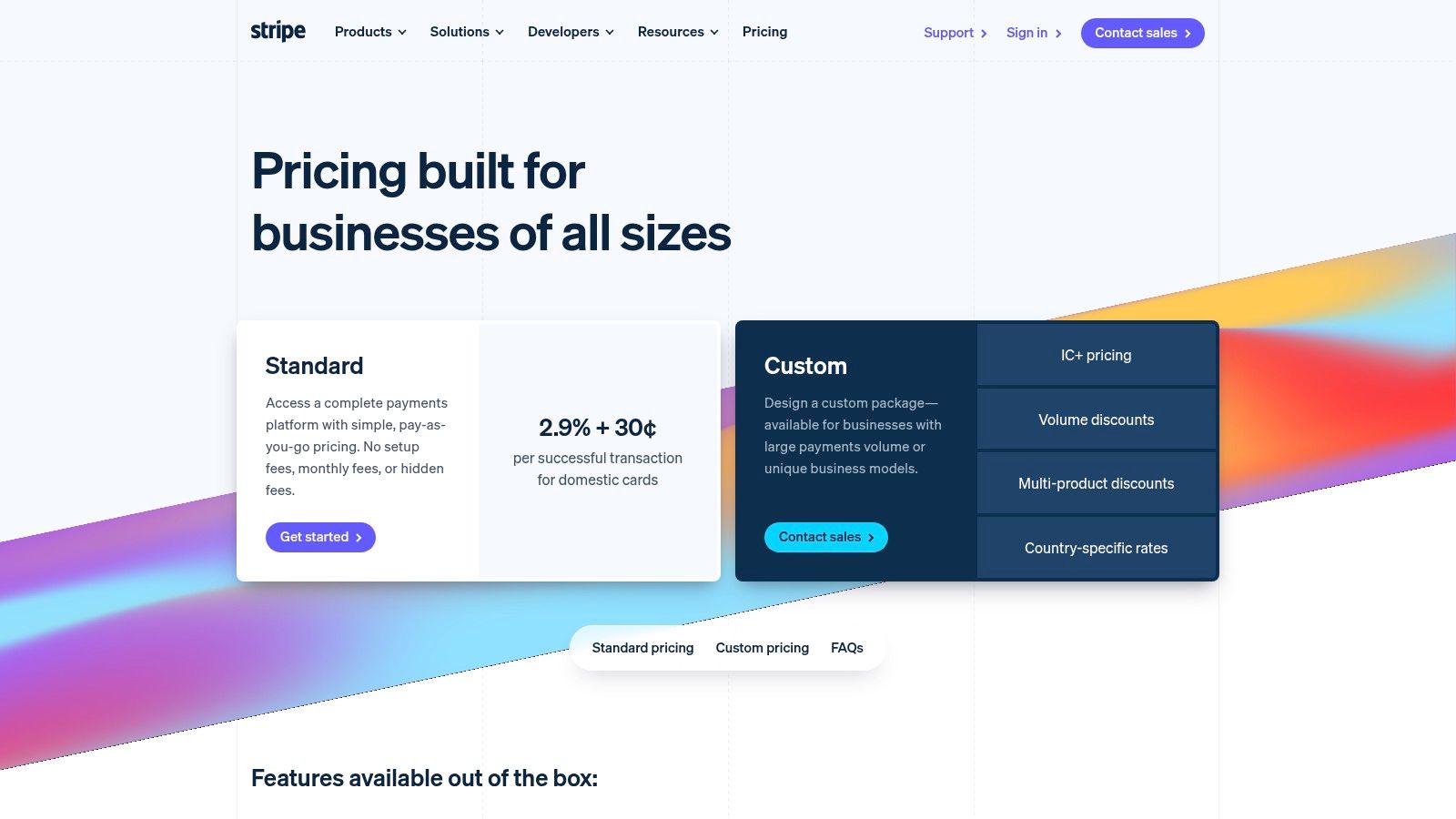

1. Stripe

Stripe is a global leader in online payments, making it a top choice among payment gateways for tutoring centers focused on scalability and automation. Its developer-first approach provides powerful APIs that allow for deep integration into management software like Tutorbase, enabling a seamless payment experience for parents and students. It’s particularly effective for centers managing recurring tuition, complex lesson packages, and prepaid credit systems.

The platform excels at handling subscriptions through Stripe Billing, which automates everything from prorated charges for mid-month sign-ups to dunning management for failed payments. This is ideal for tutoring centers that offer monthly plans or semester packages. With support for over 135 currencies and numerous payment methods like ACH debit, Stripe empowers you to serve a diverse student base effortlessly.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | 2.9% + 30¢ for online card payments. ACH Direct Debit is 0.8% (capped at $5). International cards add 1.5%. |

Subscription Tools | Stripe Billing for automated recurring invoices, trials, and prorated charges. Add-on costs may apply. |

Payout Timing | Standard 2-day rolling payouts. Instant Payouts available for a 1% fee (minimum 50¢). |

Supported Currencies | 135+ currencies and over 100 payment methods globally. |

Integration | Best-in-class APIs and documentation. Native integration with systems like Tutorbase for automated billing. |

Pros:

Unmatched Flexibility: Superior APIs allow for custom payment flows, perfect for integration with tutoring management software.

Advanced Subscription Logic: Easily manages complex billing scenarios like prepaid credits, packages, and automatic renewals.

Global Reach: Extensive currency and payment method support makes it ideal for centers with international students.

Cons:

Potential for Complexity: Leveraging its full power often requires some technical know-how or a developer.

Add-on Costs: Fees for disputes ($15 per loss), advanced fraud protection, and instant payouts can increase overall costs.

Website: https://stripe.com/pricing

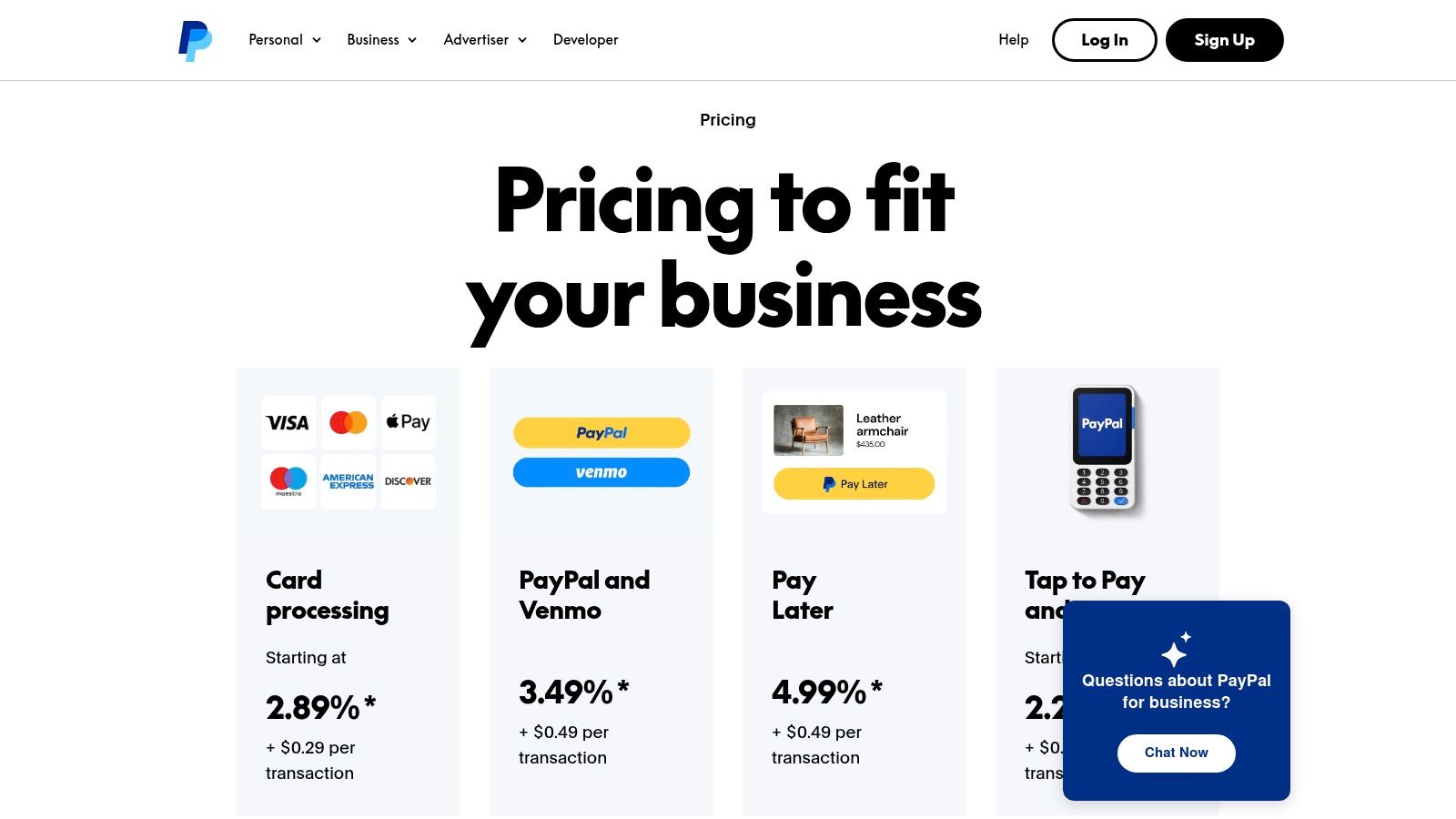

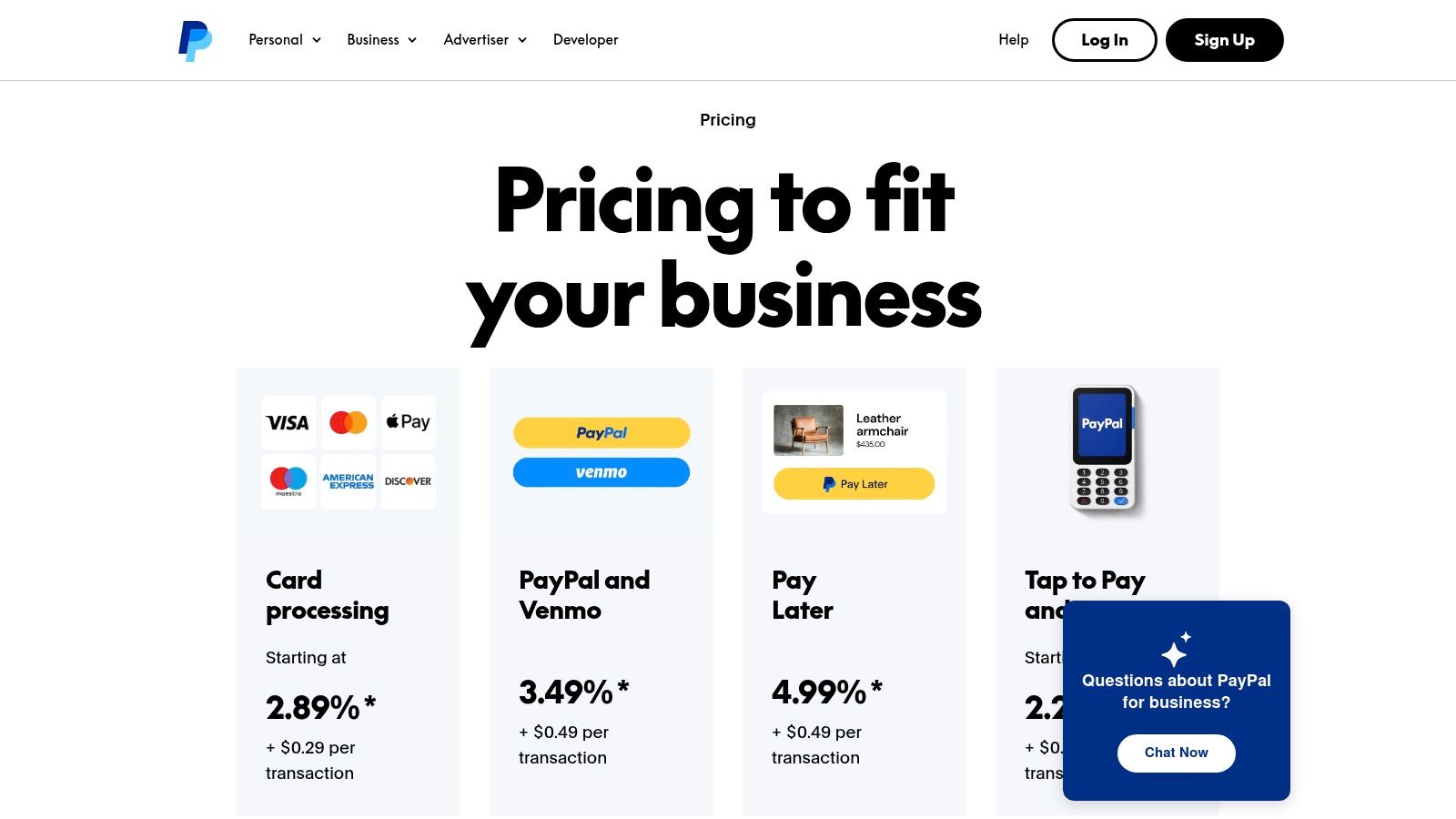

2. PayPal (PayPal Checkout, Venmo, Pay Later)

PayPal is a globally recognized payment platform, making it one of the most trusted payment gateways for tutoring centers looking for quick setup and high consumer confidence. By offering PayPal Checkout, you provide parents a familiar, one-click payment option, which can significantly speed up online registration. The inclusion of Venmo and Pay Later options further caters to modern consumer preferences, especially in the US market.

The platform is useful for straightforward payment needs like one-time class fees, package purchases, and simple recurring tuition through its invoicing tools. While it may not have the deep customization of Stripe, its ease of use makes it a strong choice for centers that need a reliable payment solution without technical overhead. The ability to integrate with accounting software simplifies financial tracking. You can learn how to integrate these tools with your accounting systems to streamline reconciliation.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | PayPal Checkout: 3.49% + 49¢ for card payments. Venmo: 3.49% + 49¢. QR code payments are lower. |

Subscription Tools | Basic recurring billing and invoicing capabilities are included for managing tuition plans and packages. |

Payout Timing | Funds are typically available in your PayPal account instantly. Transfer to a bank account takes 1-3 business days. |

Supported Currencies | Supports over 25 currencies in more than 200 markets worldwide. |

Integration | Simple to add to websites with pre-built buttons and checkouts. Less API-driven than competitors. |

Pros:

High Trust Factor: Widely recognized and trusted by parents, potentially increasing conversion rates for online payments.

Ease of Setup: Extremely fast to deploy on a website, often requiring no custom coding.

Multiple Payment Options: Bundles PayPal, Venmo, and Buy Now, Pay Later options under a single provider.

Cons:

Higher Standard Fees: Online card processing rates can be higher compared to dedicated merchant services like Stripe.

Limited Customization: Less flexible for creating complex, automated billing workflows integrated into management software.

Website: https://www.paypal.com/us/business/pricing

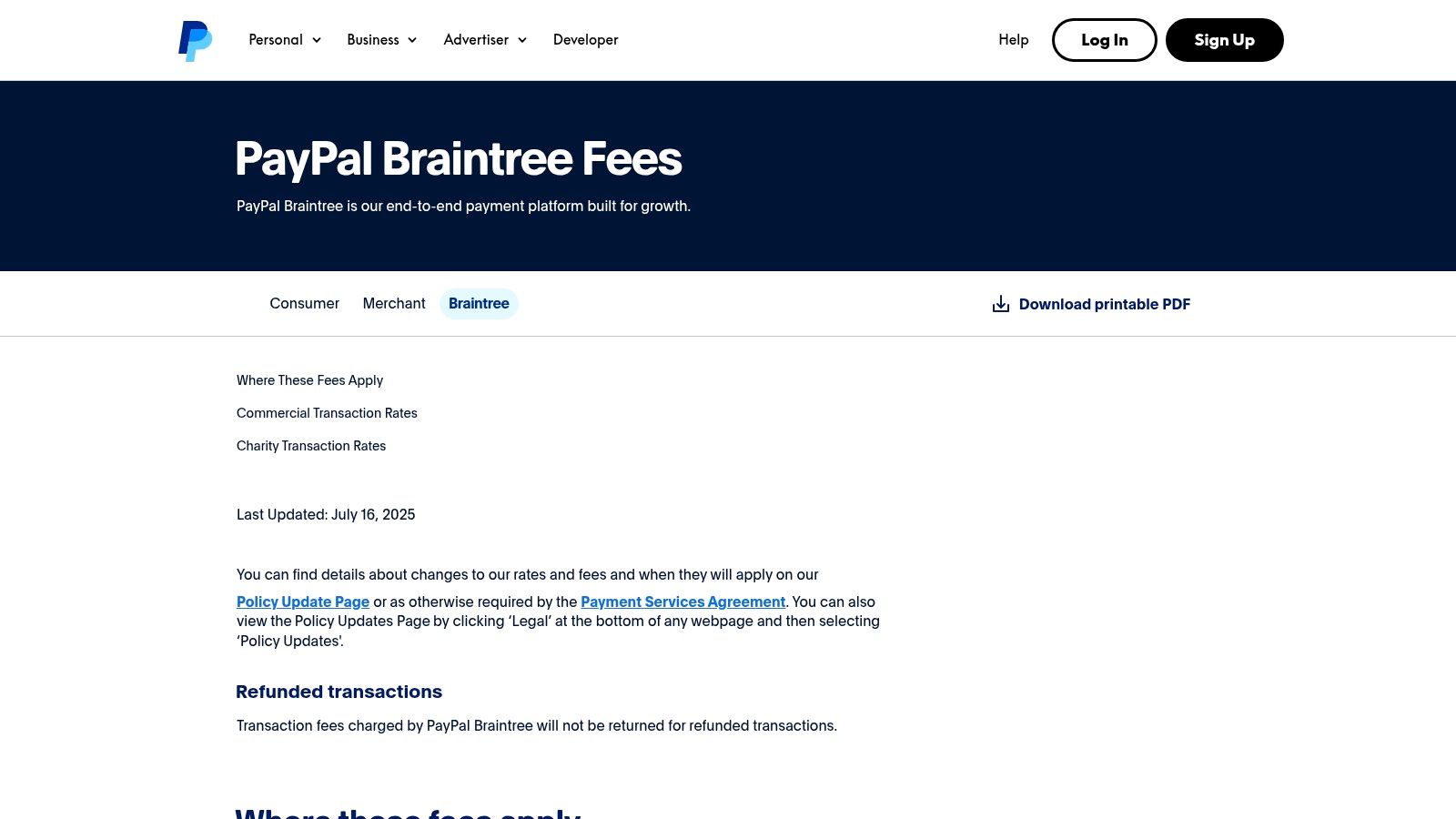

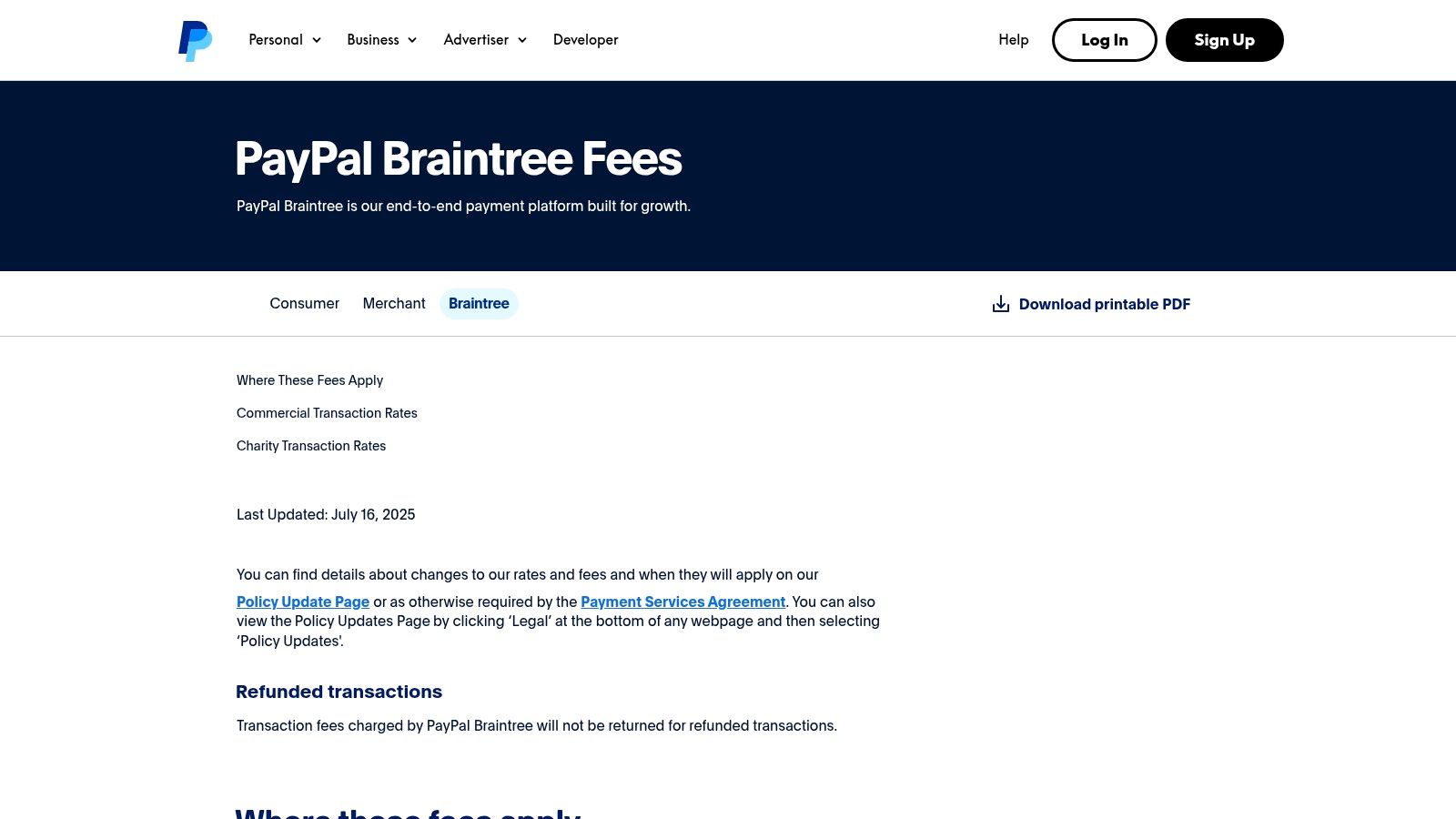

3. Braintree (a PayPal service)

Braintree, a PayPal service, operates as a full-stack payment platform, combining a gateway and merchant account into a single solution. It is an excellent choice for established tutoring centers or multi-brand educational groups needing a powerful, unified system to handle diverse payment methods. Its key advantage lies in providing direct access to PayPal and Venmo alongside traditional card and ACH payments through one integration.

The platform is designed for businesses that require more control over their payment infrastructure, such as those with custom-built student portals or those managing payments across multiple locations. With features like a secure payment vault (tokenization), Braintree allows you to safely store student payment information for hassle-free recurring billing. This makes it a strong contender among payment gateways for tutoring centers focused on a smooth, modern payment experience.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Standard 2.59% + 49¢ for cards and digital wallets. PayPal/Venmo is 3.49% + 49¢. ACH is 0.75% (capped at $5). |

Subscription Tools | Robust recurring billing engine for managing subscription plans and automated invoicing cycles. |

Payout Timing | Standard settlement is 2-5 business days depending on the payment method and region. |

Supported Currencies | Accepts payments in over 130 currencies and provides settlement in 45 currencies. |

Integration | Comprehensive API and SDKs for custom development. Connects with major e-commerce and billing platforms. |

Pros:

All-in-One Acceptance: Natively accepts credit/debit cards, PayPal, and Venmo in a single integration, broadening payment options.

Enterprise-Grade Security: Advanced fraud protection tools and secure data vaulting are ideal for growing tutoring operations.

Flexible and Scalable: Supports complex business models like marketplaces and multi-brand organizations.

Cons:

More Technical Setup: Requires more developer involvement to implement compared to simpler gateways like Square or PayPal Checkout.

Separate Fee Structures: Different processing rates for various payment methods can make cost forecasting more complex.

Website: https://www.paypal.com/us/enterprise/paypal-braintree-fees

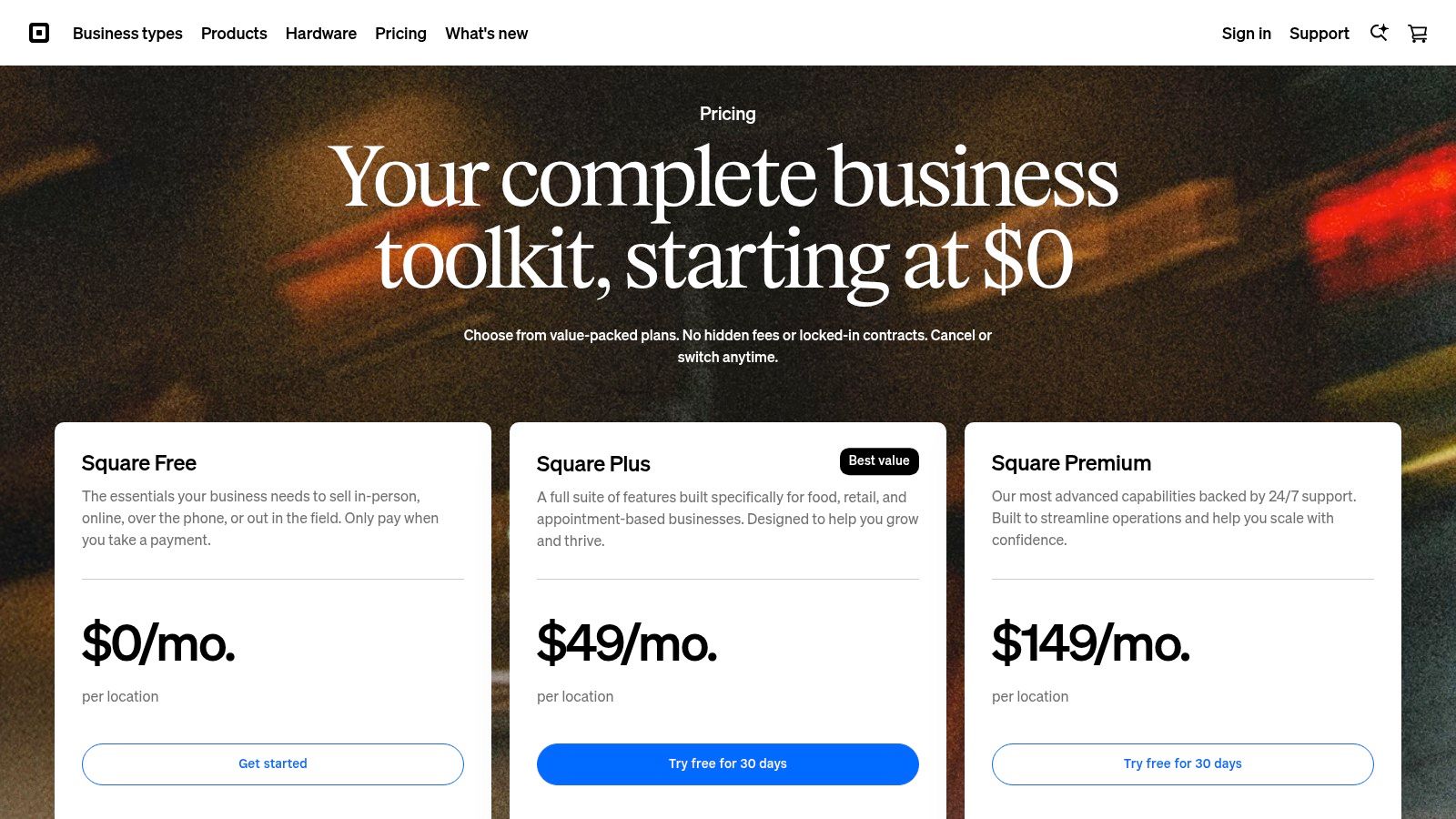

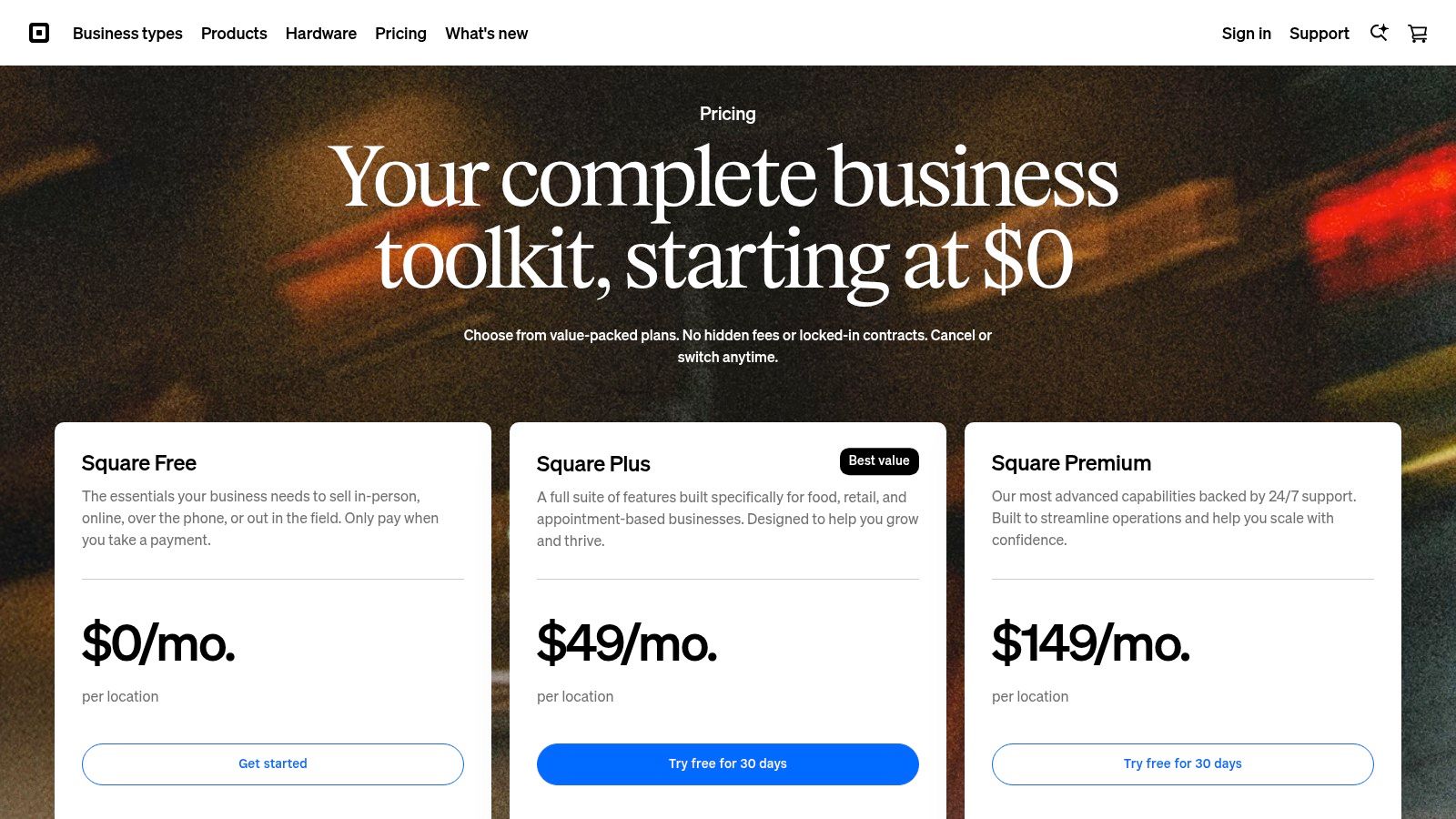

4. Square

Square is an all-in-one payment ecosystem that excels for tutoring centers needing both online and in-person payment processing. It’s particularly valuable for centers with a physical front desk, offering a seamless solution for walk-in payments, over-the-phone bookings, and online invoicing. Its quick setup and user-friendly hardware make it one of the most accessible payment gateways for tutoring centers formalizing their operations.

The platform’s strength lies in its unified approach. Using Square Invoices, you can send one-time or recurring bills for lesson packages, which parents can pay via card or ACH bank transfer. For front-desk operations, its POS terminals allow for instant collection of tuition fees. This combination of online and physical payment tools, managed from a single dashboard, is ideal for hybrid tutoring models.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | 2.9% + 30¢ for online payments. 2.6% + 10¢ for in-person payments. 3.5% + 15¢ for card-on-file or keyed-in. |

Subscription Tools | Square Invoices supports recurring billing schedules and automatic card-on-file charges. |

Payout Timing | Standard transfers in 1-2 business days. Instant transfers available for a 1.75% fee. |

Hardware | Offers a wide range of POS terminals, card readers, and registers (additional cost). |

Integration | Strong for point-of-sale and basic invoicing. API available for custom website connections. |

Pros:

Excellent for Hybrid Operations: Seamlessly combines online invoicing with robust in-person POS hardware.

Simple Setup: Extremely easy to get started with both software and hardware, no setup fees required.

Unified Dashboard: Manages all payments, customer information, and basic reporting in one place.

Cons:

Higher Fees at Scale: The flat-rate pricing can be more expensive for high-volume centers compared to interchange-plus models.

Basic Subscription Logic: Lacks the advanced dunning and proration features found in platforms like Stripe.

Website: https://squareup.com/us/en/pricing

5. Authorize.Net (a Visa solution)

Authorize.Net is one of the most established payment gateways, making it a reliable choice for tutoring centers that prefer working with a traditional merchant account. As a Visa solution, it offers robust security and wide acceptance, appealing to established schools that need to integrate a payment gateway with an existing bank relationship. It is effective for centers wanting to add online payment capabilities, including recurring billing and eCheck processing, to their current setup.

The platform provides essential tools for tuition management, like an Automated Recurring Billing service and a Customer Information Manager for securely vaulting parent payment details. Its eCheck (ACH) processing is a standout feature for collecting large tuition payments at a much lower cost than credit cards. While not as developer-centric as Stripe, Authorize.Net is widely supported by third-party software, ensuring it can connect to various systems.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Gateway Only: 10¢ per transaction + $25 monthly. All-in-One: 2.9% + 30¢ per transaction + $25 monthly. |

Subscription Tools | Automated Recurring Billing (ARB) and Customer Information Manager (CIM) for subscriptions and card vaulting. |

Payout Timing | Typically 1-2 business days, but depends on the connected merchant account provider. |

Supported Currencies | Accepts payments from most countries, but your business must be based in the US, UK, Canada, Europe, or Australia. |

Integration | Broad support across many platforms and CRMs. Works with merchant accounts from most major banks. |

Pros:

Works with Many Banks: Highly compatible with most merchant account providers, allowing you to keep your existing banking relationship.

Trusted and Secure: As a long-standing Visa solution, it offers high levels of security and reliability that parents trust.

Strong eCheck/ACH Support: Ideal for reducing transaction costs on large semester or annual tuition payments.

Cons:

Complex Pricing: Fees can vary significantly based on your reseller or merchant account provider, and a monthly fee is required.

Slower Setup: The setup process often involves a merchant account application, which is less "instant" than modern competitors.

Website: https://www.authorize.net/resources/our-features/invoicing.html

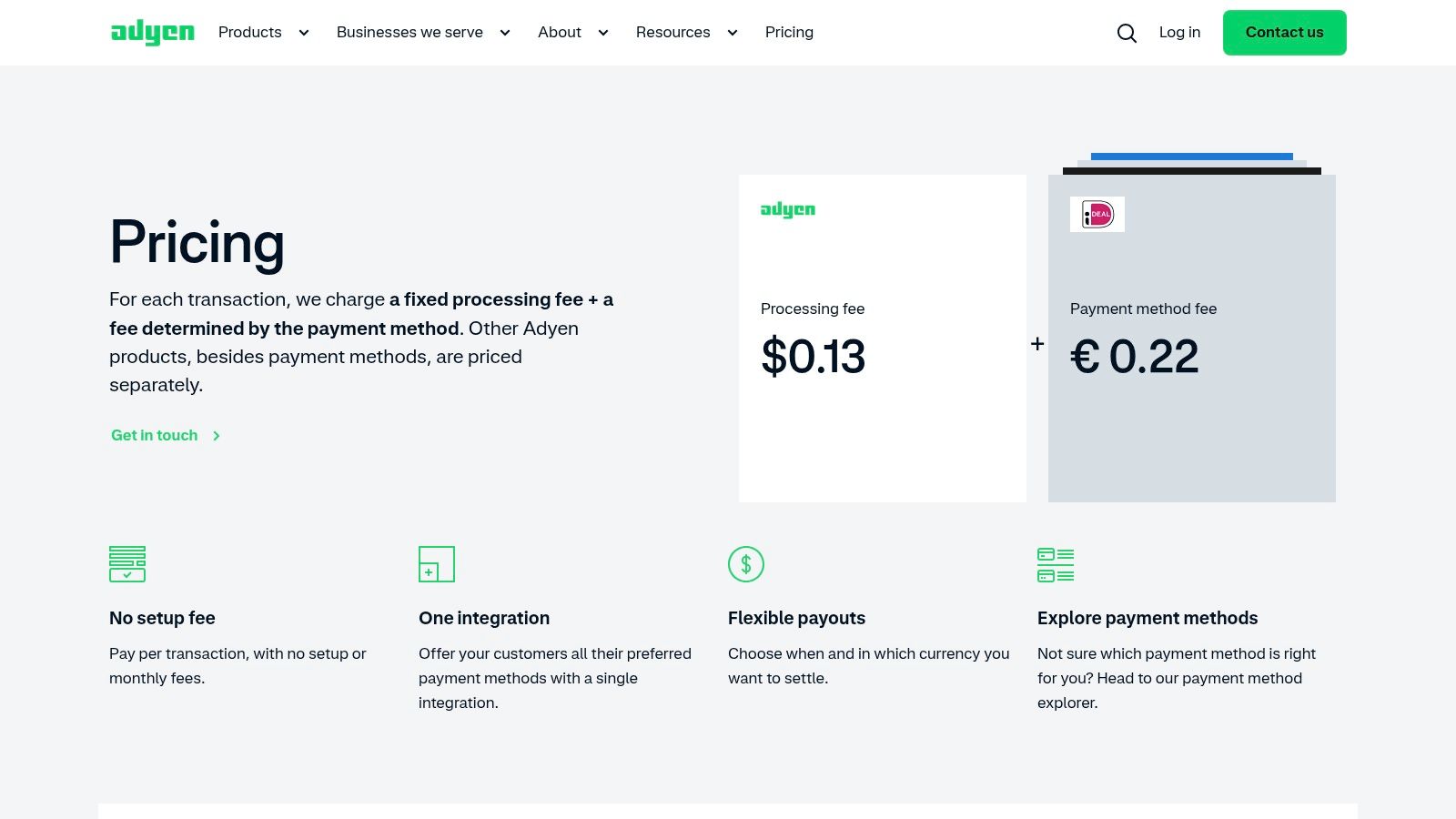

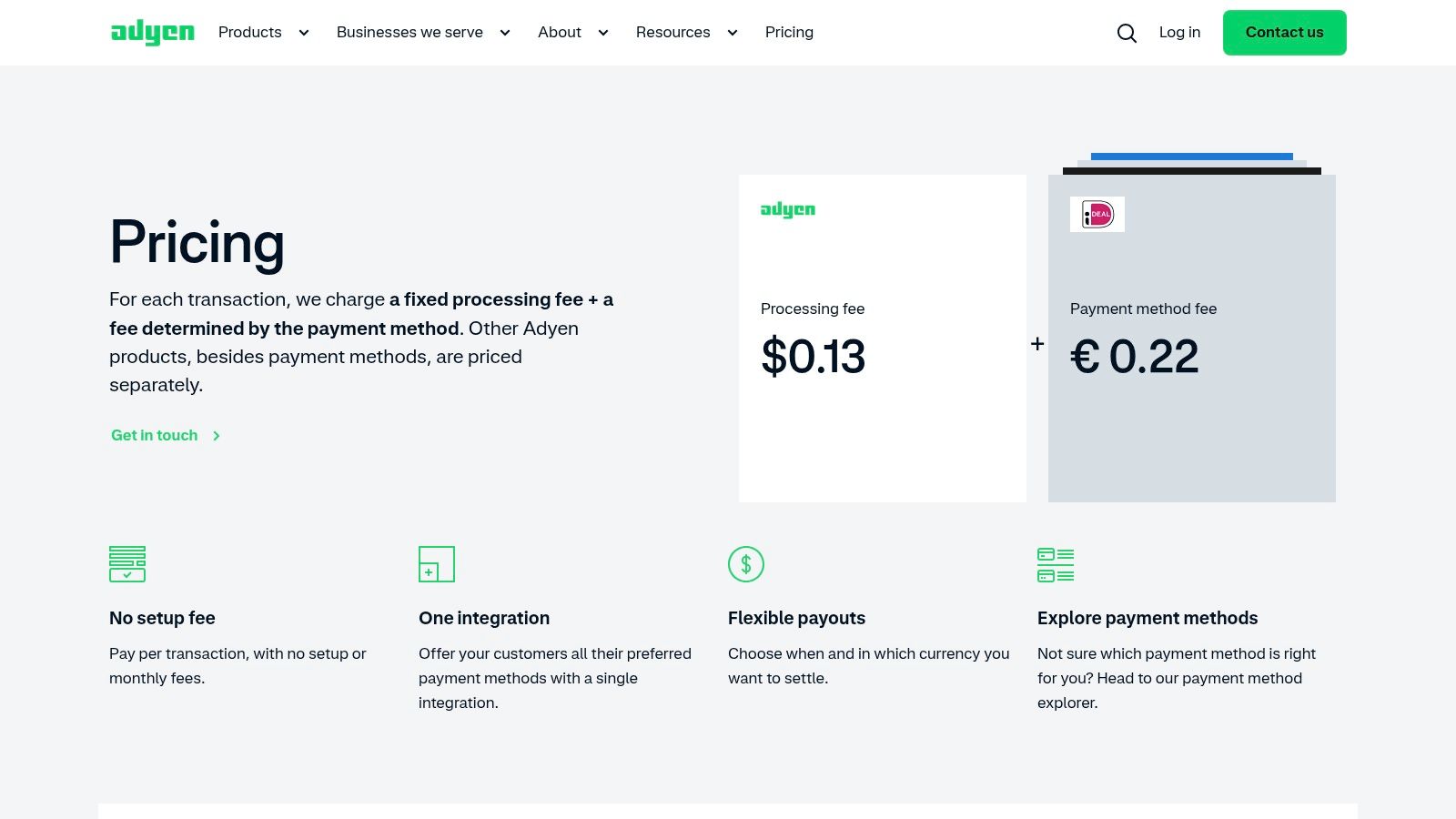

6. Adyen

Adyen is an enterprise-grade payment platform designed for large-scale operations, making it one of the top payment gateways for tutoring centers with multi-location franchises or significant international student bases. Unlike simpler platforms, Adyen acts as a direct acquirer, processor, and gateway in one, giving businesses more control over the payment flow. It is built for tutoring networks that require a unified system to handle diverse local payment methods across different countries.

The platform's strength lies in its single integration that unlocks global payment capabilities. For a language school franchise operating in Europe, Asia, and North America, Adyen can process iDEAL in the Netherlands, GrabPay in Southeast Asia, and standard credit cards in the US, all through one backend. Its advanced risk management and data-driven authorization are crucial for organizations processing high volumes of transactions.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Interchange++ pricing. A fixed processing fee (e.g., €0.12) plus fees from the card scheme and acquiring bank. |

Subscription Tools | Robust recurring payment and tokenization features suitable for enterprise-level subscription models. |

Payout Timing | Flexible and configurable payout schedules based on business needs and sales cycles. |

Supported Currencies | Supports all major currencies and a vast array of local payment methods globally. |

Integration | Requires developer involvement for API integration; not a plug-and-play solution for small businesses. |

Pros:

Superior Global Coverage: A single platform for accepting payments from nearly every country and local method.

Optimized Performance: Data-driven tools significantly improve authorization rates for high-volume centers.

Unified Commerce: Consolidates online, in-person, and mobile payments into one system for franchises.

Cons:

High Volume Requirement: Best suited for businesses processing millions in annual revenue; not for small centers.

Complex Onboarding: Setup is more involved than with platforms like Stripe and requires direct sales engagement.

Website: https://www.adyen.com/pricing

7. Checkout.com

Checkout.com is a modern, cloud-based payment platform designed for global businesses, making it an excellent choice for tutoring enterprises with multi-region operations. Unlike more straightforward gateways, Checkout.com acts as both a gateway and a processor, providing rich data and deep analytics on payment performance. This unified approach is ideal for large tutoring franchises or online learning platforms looking to optimize revenue across different countries.

The platform’s strength lies in its unified API that supports over 150 currencies and a vast array of local payment methods. For a tutoring center expanding into Europe or Asia, this means you can offer familiar payment options like iDEAL or Sofort without complex integrations. Its powerful reporting tools allow operations managers to easily reconcile payments from multiple branches or currencies.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Custom pricing based on volume and business model. Offers flat-rate or Interchange++ pricing after sales consultation. |

Subscription Tools | Robust API allows developers to build custom subscription logic for tuition plans and recurring billing. |

Payout Timing | Flexible and configurable settlement schedules based on your business needs and geography. |

Supported Currencies | 150+ processing currencies and numerous local payment methods worldwide. |

Integration | API-first platform designed for custom development. Less plug-and-play than competitors like Stripe or PayPal. |

Pros:

Enterprise-Grade Performance: Highly reliable and scalable, built for large-scale operations and international transactions.

Powerful Analytics: Provides granular data on payment acceptance rates, helping to optimize revenue and reduce declines.

Flexible Pricing Models: Can offer more competitive rates for high-volume centers compared to standard flat-rate pricing.

Cons:

Requires Technical Resources: Best suited for tutoring businesses with access to developers to leverage its powerful API.

No Public Pricing: You must engage with their sales team to get a quote, which is less ideal for smaller centers.

Website: https://www.checkout.com/pricing

8. Worldpay (from FIS)

For large, multi-location tutoring networks or tech-savvy centers running proprietary management software, Worldpay offers a powerful, embedded payment solution. Rather than just being a simple gateway, it allows a tutoring business to become its own payment facilitator (PayFac). This is ideal for franchise models that want to centralize payment processing and standardize fees across branches.

This model transforms payments from a simple utility into a core part of your business infrastructure. It provides the tools to manage a complex portfolio of sub-accounts (e.g., individual franchise locations), set custom transaction fees, and oversee risk from a central dashboard. While it represents a significant step up in complexity, it offers unmatched control for large-scale operations looking to build a seamless, branded payment experience.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Custom pricing. Not publicly available and requires direct sales consultation. |

Subscription Tools | Robust APIs and tools for creating and managing recurring billing plans tailored to platform needs. |

Payout Timing | Configurable payout schedules based on the chosen PayFac model and risk assessment. |

Supported Currencies | Extensive global currency and payment method support, designed for international platforms. |

Integration | Designed for deep, API-driven integration into custom software platforms (PayFac-as-a-Service). |

Pros:

Monetization Potential: Flexible models allow tutoring networks to share in payment revenue and set their own fee structures.

Ultimate Control: Provides complete command over the payment experience, branding, and onboarding for sub-accounts.

Scalability & Compliance: Built to handle high transaction volumes with strong risk and compliance support for platform models.

Cons:

Significant Complexity: This is not a plug-and-play solution and requires substantial technical and operational investment.

Opaque Pricing: All pricing is negotiated, making it difficult to estimate costs without a formal sales process.

Overkill for Most Centers: Far too complex for single-location tutoring businesses or those without custom software.

Website: https://platforms.worldpay.com/

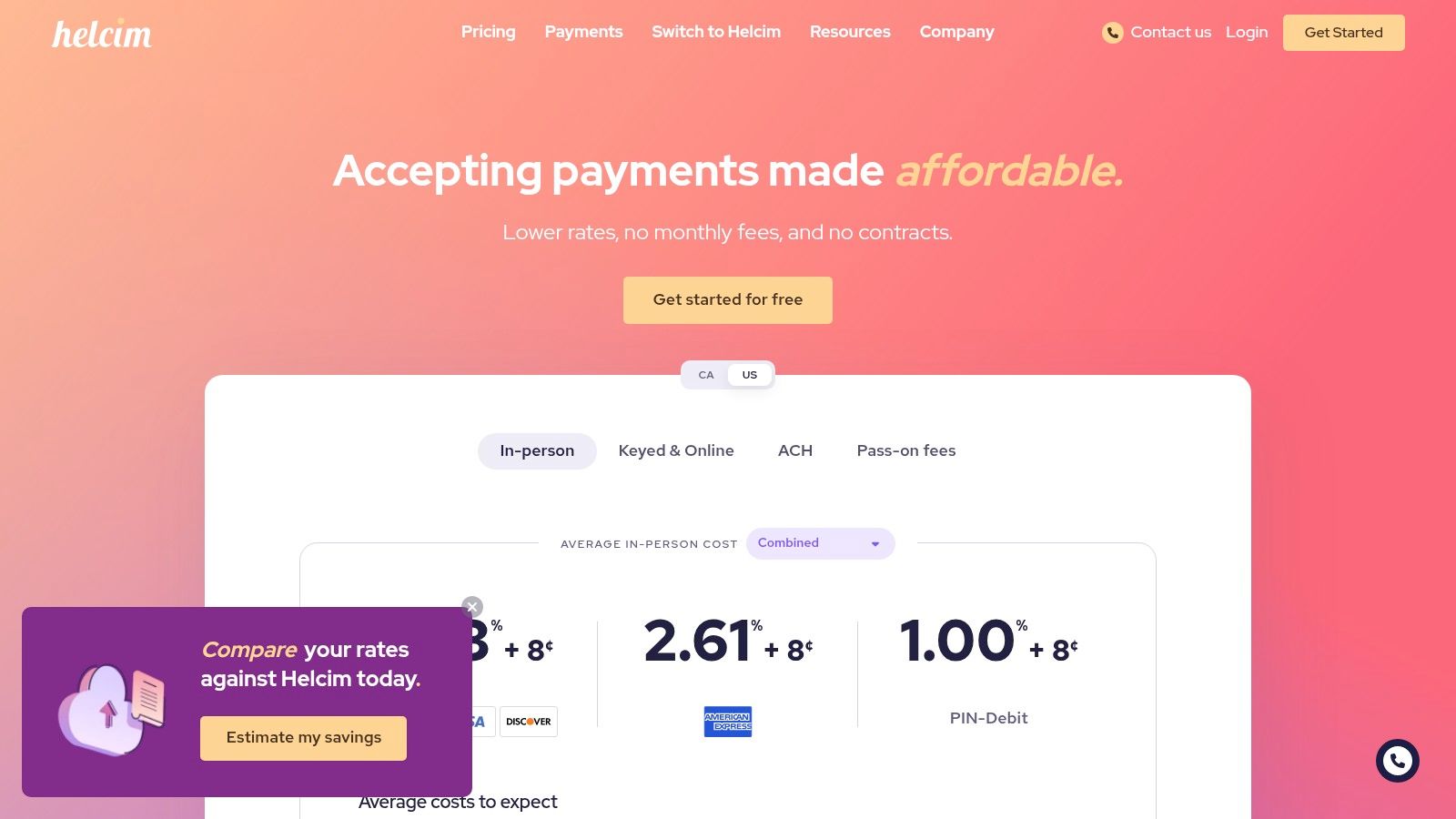

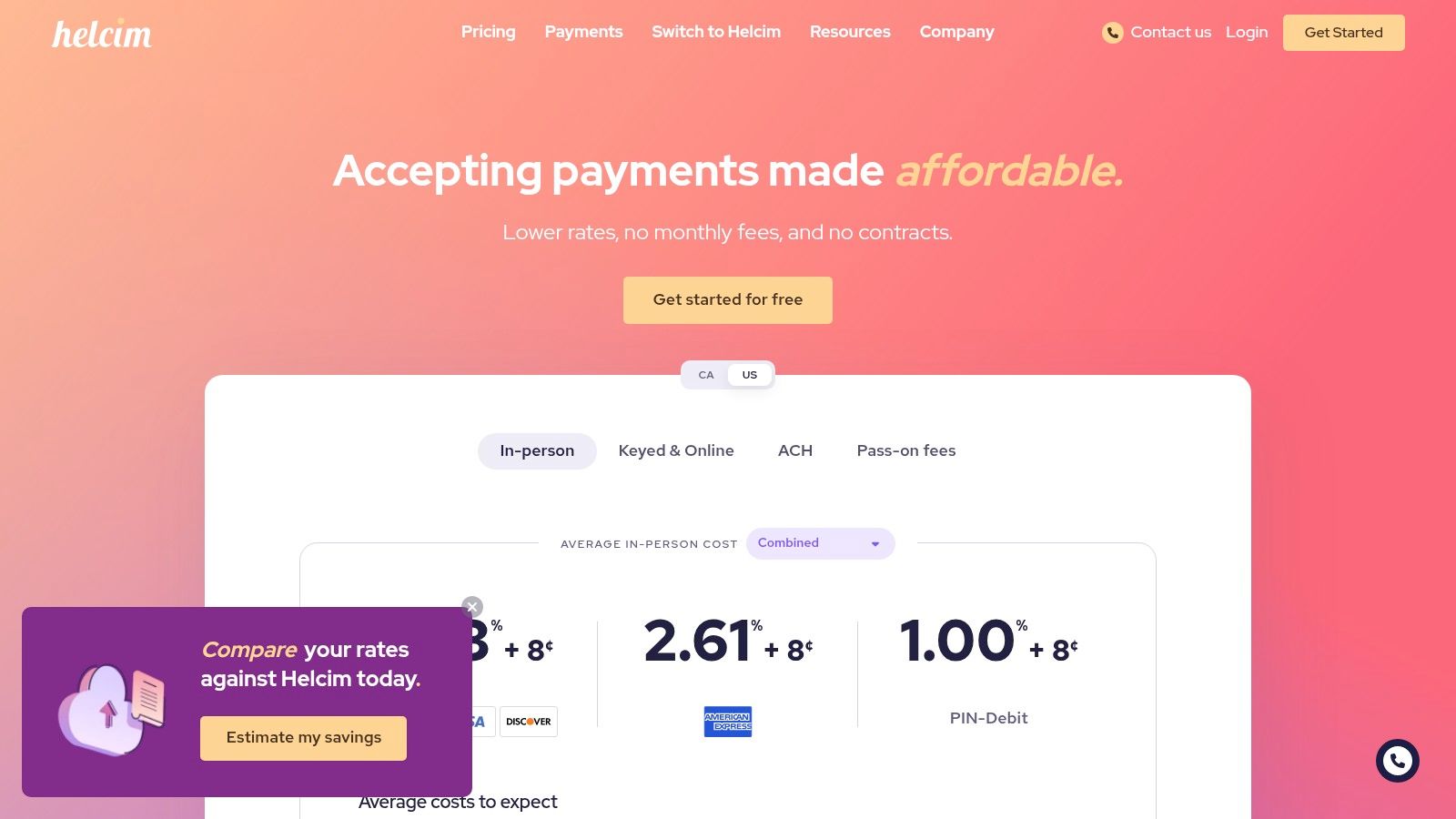

9. Helcim

Helcim distinguishes itself by offering interchange-plus pricing, a highly transparent model that can significantly lower costs for tutoring centers processing a steady volume of transactions. Instead of a flat rate, you pay the direct wholesale cost of a transaction plus a small, fixed margin. This structure makes it one of the most cost-effective payment gateways for tutoring centers focused on maximizing every dollar.

The platform comes with a suite of built-in tools at no extra cost, including invoicing, recurring payment plans, and hosted payment pages. This is a major advantage for centers that need subscription and invoicing features without paying extra for them. Helcim is an excellent fit for growing tutoring businesses that want predictable costs without sacrificing essential functionality. This clear pricing model also helps when you need to determine how much to charge for tutoring services by making your operational costs easier to forecast.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Interchange + 0.50% and 25¢ for online card payments. In-person is Interchange + 0.30% and 8¢. ACH is 0.5% + 25¢. |

Subscription Tools | Built-in recurring billing and subscription management included at no additional cost. |

Payout Timing | Standard payouts in 1-2 business days. |

Supported Currencies | Primarily focused on USD and CAD transactions. |

Integration | Offers a solid API and pre-built integrations. Best for custom-built sites or using its hosted payment pages. |

Pros:

Transparent Pricing: Interchange-plus model can lead to significant savings as your processing volume grows.

No Hidden Fees: Zero monthly fees, no PCI compliance fees, and no setup costs.

Included Business Tools: Free access to invoicing, recurring payments, and a virtual terminal adds tremendous value.

Cons:

Complex Rate Structure: Interchange pricing is harder to predict than flat-rate, as fees vary by card type.

Hardware is Extra: While reasonably priced, physical terminals for in-person payments are an additional cost.

Website: https://www.helcim.com/pricing/

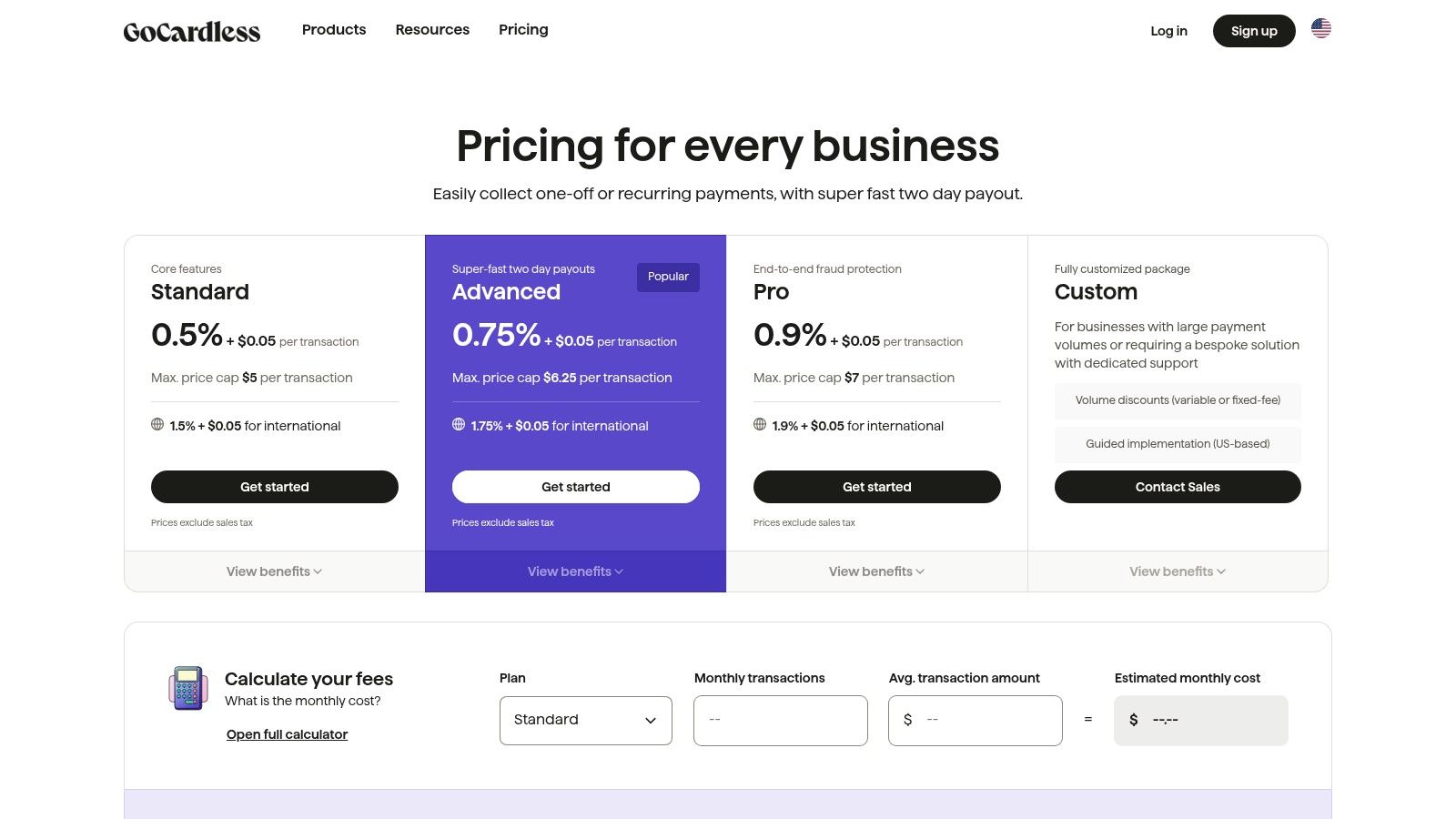

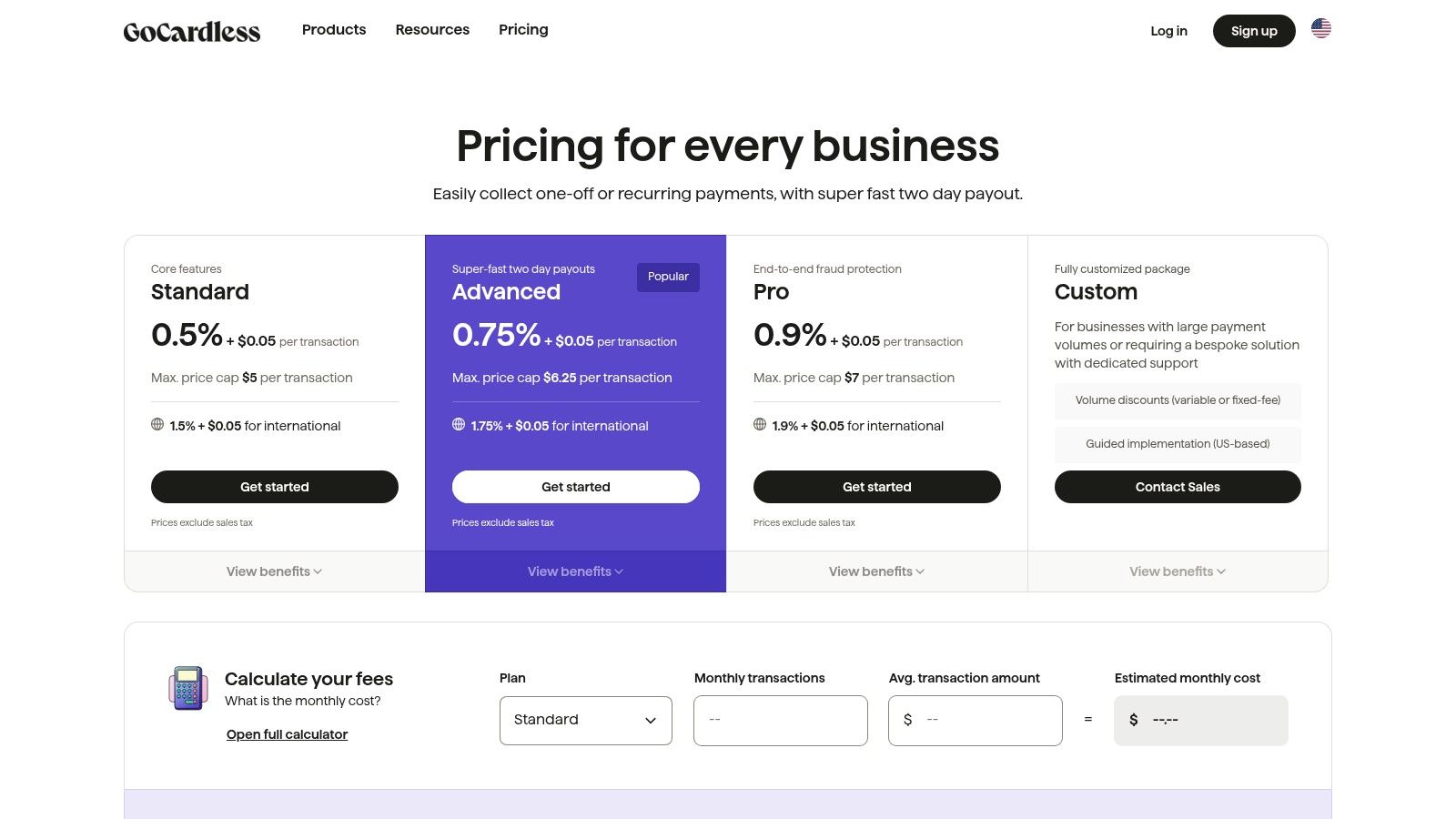

10. GoCardless

GoCardless offers a specialized approach to payments that makes it a strategic addition for tutoring centers, particularly those managing predictable, recurring tuition fees. Instead of processing credit cards, it focuses exclusively on bank-to-bank payments through ACH debit. This method is ideal for automating monthly subscriptions or semester-long payment plans, as it pulls funds directly from a parent’s bank account. This significantly reduces transaction fees and nearly eliminates chargebacks.

The platform is designed to complement your existing card processor, not replace it. You can use GoCardless for committed, long-term students on recurring plans while offering credit card payments for one-off lessons. It excels with its automated tools for handling payment failures, including intelligent retries (Success+), and integrates with over 350 accounting platforms like Xero and QuickBooks. This makes reconciliation for tuition payments incredibly simple.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | 1% + 25¢ per transaction for domestic ACH debit, capped at $10. International payments cost more. |

Subscription Tools | Robust features for creating and managing recurring payment plans and one-off invoices via bank debit. |

Payout Timing | Payouts arrive 2 business days after payment collection. |

Supported Currencies | Collect payments from over 30 countries, including the US, UK, Canada, Australia, and the Eurozone. |

Integration | Strong API and over 350 direct integrations with accounting and business software. |

Pros:

Lower Transaction Costs: Significantly cheaper than card processing for recurring tuition payments.

Reduced Chargeback Risk: Bank-authorized mandates make disputes far less common than with credit cards.

High Payment Success Rate: Automated retries and bank verification help ensure payments are collected on time.

Cons:

Not a Card Processor: It only handles bank payments, so you'll need another gateway for card acceptance.

Slower Initial Setup: Parents must complete a one-time authorization (mandate) for their bank account.

Website: https://gocardless.com/en-us/pricing/

Top 10 Payment Gateways for Tutoring Centers — Comparison

Product | Best For | Key Feature | Integration & UX | Pricing Model |

|---|---|---|---|---|

Stripe | Centers needing flexibility and automation | Deep integration, recurring billing, global payments | Developer-friendly APIs, connects to Tutorbase | 2.9% + 30¢ (online cards) |

PayPal | Quick setup and high parent trust | Familiar checkout, Venmo & Pay Later options | Easy plug-and-play widgets | 3.49% + 49¢ (online) |

Braintree | Multi-brand groups with custom portals | Unified card, PayPal, and Venmo acceptance | API-driven, more technical setup | 2.59% + 49¢ (cards) |

Square | Hybrid centers with in-person payments | All-in-one POS hardware and online invoicing | Simple to deploy, user-friendly interface | 2.6% + 10¢ (in-person) |

Authorize.Net | Centers with existing merchant accounts | Strong eCheck/ACH support, works with many banks | Broad support, requires merchant account | $25/month + transaction fees |

Adyen | Large, international tutoring franchises | Unified global payment methods, optimized rates | Enterprise-level API, requires developer resources | Custom Interchange++ |

Checkout.com | Multi-region centers needing deep analytics | Global processing with powerful reporting | API-first, requires technical team | Custom, volume-based |

Worldpay | Franchise networks building custom platforms | Embedded payments (PayFac model) | Deep API integration for platform models | Custom, sales-led |

Helcim | Cost-conscious centers seeking transparency | Interchange-plus pricing, no monthly fees | Straightforward setup with included tools | Interchange + fixed margin |

GoCardless | Automating recurring tuition via bank debit | Low-cost ACH payments, reduced chargebacks | API connects to accounting software | 1% + 25¢ (capped at $10) |

How to Automate Payments and Scale Your Operations

Choosing the right payment gateway is a critical decision that impacts your tutoring center's cash flow, administrative workload, and ability to scale. As we've explored, the landscape of payment processing is diverse. Solutions like Stripe offer unparalleled developer tools and seamless integration with platforms like Tutorbase, making it the top choice for most growing centers. PayPal and Square provide simplicity, ideal for new businesses prioritizing quick setup.

For centers with more complex needs, such as multi-branch operations, processors like Adyen and Checkout.com present powerful, unified platforms. Meanwhile, providers like Helcim appeal to budget-conscious owners with its transparent pricing, and GoCardless offers a cost-effective solution for businesses reliant on recurring bank debits. Your final choice will depend on your specific operational model, transaction volume, and growth ambitions.

From Payment Processing to Business Automation

However, selecting a payment gateway is only the first step. The true operational leap comes from integrating it into a comprehensive tutoring management system. A standalone gateway still leaves you with the manual tasks of creating invoices, chasing payments, updating student ledgers, and reconciling accounts. This is where the administrative bottleneck forms.

The goal is to move beyond simple payment collection and achieve full financial automation. This means connecting attendance directly to invoicing, invoicing to payment processing, and payments back to your financial reports and payroll. When these systems are linked, the workflow is seamless. For instance, a teacher marks attendance, which automatically generates an invoice that is paid via an integrated portal, and the teacher's corresponding payroll is calculated accurately. This level of automation is what transforms a tutoring center from a manually run operation into a scalable business. You can explore resources on effective payment provider integration to understand the technical foundations.

Key Considerations for Implementation

Before you commit, consider these final implementation factors:

Total Cost of Ownership: Look beyond the advertised transaction fees. Factor in monthly fees, chargeback costs, and the administrative hours you will save.

Parent Experience: The payment process is a key customer touchpoint. A clunky experience can lead to frustration and churn. Make it easy for parents to pay online, set up recurring billing, or view their payment history.

Integration is Non-Negotiable: Your payment gateway should not be an island. Prioritize a solution that integrates natively with your core management software. This eliminates duplicate data entry and reduces human error.

Scalability: The gateway that works for you today with 50 students might not be the right fit at 500. Choose a partner that can grow with you, supporting higher transaction volumes, prepaid credits, and subscriptions.

Ultimately, automating your payment workflow is about reclaiming your time. By making the right choice, you lay the financial foundation for sustainable growth, allowing you to focus less on administrative drag and more on what you do best: delivering exceptional education.

Frequently Asked Questions (FAQ)

What is the cheapest payment gateway for a tutoring center?

For recurring tuition, GoCardless is often the cheapest due to its low, capped fees for ACH bank debits. For credit card processing, Helcim's interchange-plus pricing model can be the most cost-effective for centers with steady transaction volume, as it avoids the higher markups of flat-rate providers.

Can I use more than one payment gateway?

Yes, many tutoring centers use multiple gateways. A common strategy is to use a primary processor like Stripe for credit card payments (for flexibility and new sign-ups) and a secondary one like GoCardless for lower-cost, recurring ACH payments from long-term students.

How does a payment gateway handle recurring billing for tuition?

Most top payment gateways offer subscription or recurring billing tools. You can set up automated payment plans (e.g., weekly, monthly, per semester) where the system automatically charges a parent's saved card or bank account on a schedule. This eliminates the need for manual invoicing and payment chasing each cycle.

Do I need a merchant account to use a payment gateway?

Not always. Modern payment service providers (PSPs) like Stripe, PayPal, and Square combine the merchant account and payment gateway into one service, simplifying the setup process. Traditional gateways like Authorize.Net typically require you to have a separate merchant account with a bank.

How do payment gateways integrate with tutoring management software like Tutorbase?

Payment gateways integrate with software like Tutorbase via an API (Application Programming Interface). This allows the two systems to communicate securely. When integrated, you can automatically generate invoices from lesson attendance, send payment links to parents, and reconcile payments directly within your management dashboard, which saves over 10 hours of admin work per week.

Ready to eliminate 10+ hours of weekly admin and automate your entire billing cycle? Tutorbase integrates directly with leading payment gateways like Stripe to turn attendance into paid invoices and accurate payroll, seamlessly. Stop chasing payments and start scaling your tutoring center.

The Top 10 Payment Gateways for Tutoring Centers in 2026: A Complete Guide

Published: January 10, 2026 by Amy Ashford

Key Takeaway: Choosing the right payment gateway automates your cash flow, reduces admin time by up to 60%, and improves the parent experience. Stripe offers the best flexibility for integration with tutoring management software like Tutorbase, while options like Square and PayPal provide simple setups for new centers.

Choosing the right payment gateway is about more than just collecting tuition. It is about automating your cash flow, reducing administrative hours, and improving the parent experience. Many tutoring centers lose money not from a lack of students, but from manual invoicing, chasing late payments, and using fragmented tools that do not talk to each other. An inefficient payment process consumes 10+ hours per week that owners could spend on student retention and marketing.

This guide breaks down the top 10 payment gateways for tutoring centers, evaluating them on features that actually matter for your business. We analyze each option for its suitability for different center sizes, from a solo tutor building a team to a multi-location language academy. While broader lists of the 12 best payment gateways for small business in 2025 provide a great market overview, our focus is tailored specifically to the unique billing needs of educational businesses, such as prepaid credits and complex payroll.

You will find a detailed, actionable comparison covering everything from transaction fees and recurring subscription support to integration with tutoring management software like Tutorbase. Each entry includes screenshots and direct links, so you can stop wrestling with payments and focus on teaching. We explore how each platform handles critical tasks like payment reconciliation, dispute management, and payout timing, helping you find the perfect fit.

What is a Payment Gateway?

A payment gateway is a service that securely authorizes and processes credit card or direct bank payments for online and in-person transactions. It acts as the bridge between your tutoring center's website or management software and the bank networks, ensuring parents' payment information is encrypted and transactions are handled safely.

Why do tutoring centers need a payment gateway?

Tutoring centers need a payment gateway to stop wasting time on manual admin tasks. Instead of creating paper invoices, chasing checks, or running cards one by one, a gateway automates the entire process. This reduces booking errors, ensures consistent cash flow, and provides parents with a professional, convenient way to pay for lessons.

1. Stripe

Stripe is a global leader in online payments, making it a top choice among payment gateways for tutoring centers focused on scalability and automation. Its developer-first approach provides powerful APIs that allow for deep integration into management software like Tutorbase, enabling a seamless payment experience for parents and students. It’s particularly effective for centers managing recurring tuition, complex lesson packages, and prepaid credit systems.

The platform excels at handling subscriptions through Stripe Billing, which automates everything from prorated charges for mid-month sign-ups to dunning management for failed payments. This is ideal for tutoring centers that offer monthly plans or semester packages. With support for over 135 currencies and numerous payment methods like ACH debit, Stripe empowers you to serve a diverse student base effortlessly.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | 2.9% + 30¢ for online card payments. ACH Direct Debit is 0.8% (capped at $5). International cards add 1.5%. |

Subscription Tools | Stripe Billing for automated recurring invoices, trials, and prorated charges. Add-on costs may apply. |

Payout Timing | Standard 2-day rolling payouts. Instant Payouts available for a 1% fee (minimum 50¢). |

Supported Currencies | 135+ currencies and over 100 payment methods globally. |

Integration | Best-in-class APIs and documentation. Native integration with systems like Tutorbase for automated billing. |

Pros:

Unmatched Flexibility: Superior APIs allow for custom payment flows, perfect for integration with tutoring management software.

Advanced Subscription Logic: Easily manages complex billing scenarios like prepaid credits, packages, and automatic renewals.

Global Reach: Extensive currency and payment method support makes it ideal for centers with international students.

Cons:

Potential for Complexity: Leveraging its full power often requires some technical know-how or a developer.

Add-on Costs: Fees for disputes ($15 per loss), advanced fraud protection, and instant payouts can increase overall costs.

Website: https://stripe.com/pricing

2. PayPal (PayPal Checkout, Venmo, Pay Later)

PayPal is a globally recognized payment platform, making it one of the most trusted payment gateways for tutoring centers looking for quick setup and high consumer confidence. By offering PayPal Checkout, you provide parents a familiar, one-click payment option, which can significantly speed up online registration. The inclusion of Venmo and Pay Later options further caters to modern consumer preferences, especially in the US market.

The platform is useful for straightforward payment needs like one-time class fees, package purchases, and simple recurring tuition through its invoicing tools. While it may not have the deep customization of Stripe, its ease of use makes it a strong choice for centers that need a reliable payment solution without technical overhead. The ability to integrate with accounting software simplifies financial tracking. You can learn how to integrate these tools with your accounting systems to streamline reconciliation.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | PayPal Checkout: 3.49% + 49¢ for card payments. Venmo: 3.49% + 49¢. QR code payments are lower. |

Subscription Tools | Basic recurring billing and invoicing capabilities are included for managing tuition plans and packages. |

Payout Timing | Funds are typically available in your PayPal account instantly. Transfer to a bank account takes 1-3 business days. |

Supported Currencies | Supports over 25 currencies in more than 200 markets worldwide. |

Integration | Simple to add to websites with pre-built buttons and checkouts. Less API-driven than competitors. |

Pros:

High Trust Factor: Widely recognized and trusted by parents, potentially increasing conversion rates for online payments.

Ease of Setup: Extremely fast to deploy on a website, often requiring no custom coding.

Multiple Payment Options: Bundles PayPal, Venmo, and Buy Now, Pay Later options under a single provider.

Cons:

Higher Standard Fees: Online card processing rates can be higher compared to dedicated merchant services like Stripe.

Limited Customization: Less flexible for creating complex, automated billing workflows integrated into management software.

Website: https://www.paypal.com/us/business/pricing

3. Braintree (a PayPal service)

Braintree, a PayPal service, operates as a full-stack payment platform, combining a gateway and merchant account into a single solution. It is an excellent choice for established tutoring centers or multi-brand educational groups needing a powerful, unified system to handle diverse payment methods. Its key advantage lies in providing direct access to PayPal and Venmo alongside traditional card and ACH payments through one integration.

The platform is designed for businesses that require more control over their payment infrastructure, such as those with custom-built student portals or those managing payments across multiple locations. With features like a secure payment vault (tokenization), Braintree allows you to safely store student payment information for hassle-free recurring billing. This makes it a strong contender among payment gateways for tutoring centers focused on a smooth, modern payment experience.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Standard 2.59% + 49¢ for cards and digital wallets. PayPal/Venmo is 3.49% + 49¢. ACH is 0.75% (capped at $5). |

Subscription Tools | Robust recurring billing engine for managing subscription plans and automated invoicing cycles. |

Payout Timing | Standard settlement is 2-5 business days depending on the payment method and region. |

Supported Currencies | Accepts payments in over 130 currencies and provides settlement in 45 currencies. |

Integration | Comprehensive API and SDKs for custom development. Connects with major e-commerce and billing platforms. |

Pros:

All-in-One Acceptance: Natively accepts credit/debit cards, PayPal, and Venmo in a single integration, broadening payment options.

Enterprise-Grade Security: Advanced fraud protection tools and secure data vaulting are ideal for growing tutoring operations.

Flexible and Scalable: Supports complex business models like marketplaces and multi-brand organizations.

Cons:

More Technical Setup: Requires more developer involvement to implement compared to simpler gateways like Square or PayPal Checkout.

Separate Fee Structures: Different processing rates for various payment methods can make cost forecasting more complex.

Website: https://www.paypal.com/us/enterprise/paypal-braintree-fees

4. Square

Square is an all-in-one payment ecosystem that excels for tutoring centers needing both online and in-person payment processing. It’s particularly valuable for centers with a physical front desk, offering a seamless solution for walk-in payments, over-the-phone bookings, and online invoicing. Its quick setup and user-friendly hardware make it one of the most accessible payment gateways for tutoring centers formalizing their operations.

The platform’s strength lies in its unified approach. Using Square Invoices, you can send one-time or recurring bills for lesson packages, which parents can pay via card or ACH bank transfer. For front-desk operations, its POS terminals allow for instant collection of tuition fees. This combination of online and physical payment tools, managed from a single dashboard, is ideal for hybrid tutoring models.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | 2.9% + 30¢ for online payments. 2.6% + 10¢ for in-person payments. 3.5% + 15¢ for card-on-file or keyed-in. |

Subscription Tools | Square Invoices supports recurring billing schedules and automatic card-on-file charges. |

Payout Timing | Standard transfers in 1-2 business days. Instant transfers available for a 1.75% fee. |

Hardware | Offers a wide range of POS terminals, card readers, and registers (additional cost). |

Integration | Strong for point-of-sale and basic invoicing. API available for custom website connections. |

Pros:

Excellent for Hybrid Operations: Seamlessly combines online invoicing with robust in-person POS hardware.

Simple Setup: Extremely easy to get started with both software and hardware, no setup fees required.

Unified Dashboard: Manages all payments, customer information, and basic reporting in one place.

Cons:

Higher Fees at Scale: The flat-rate pricing can be more expensive for high-volume centers compared to interchange-plus models.

Basic Subscription Logic: Lacks the advanced dunning and proration features found in platforms like Stripe.

Website: https://squareup.com/us/en/pricing

5. Authorize.Net (a Visa solution)

Authorize.Net is one of the most established payment gateways, making it a reliable choice for tutoring centers that prefer working with a traditional merchant account. As a Visa solution, it offers robust security and wide acceptance, appealing to established schools that need to integrate a payment gateway with an existing bank relationship. It is effective for centers wanting to add online payment capabilities, including recurring billing and eCheck processing, to their current setup.

The platform provides essential tools for tuition management, like an Automated Recurring Billing service and a Customer Information Manager for securely vaulting parent payment details. Its eCheck (ACH) processing is a standout feature for collecting large tuition payments at a much lower cost than credit cards. While not as developer-centric as Stripe, Authorize.Net is widely supported by third-party software, ensuring it can connect to various systems.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Gateway Only: 10¢ per transaction + $25 monthly. All-in-One: 2.9% + 30¢ per transaction + $25 monthly. |

Subscription Tools | Automated Recurring Billing (ARB) and Customer Information Manager (CIM) for subscriptions and card vaulting. |

Payout Timing | Typically 1-2 business days, but depends on the connected merchant account provider. |

Supported Currencies | Accepts payments from most countries, but your business must be based in the US, UK, Canada, Europe, or Australia. |

Integration | Broad support across many platforms and CRMs. Works with merchant accounts from most major banks. |

Pros:

Works with Many Banks: Highly compatible with most merchant account providers, allowing you to keep your existing banking relationship.

Trusted and Secure: As a long-standing Visa solution, it offers high levels of security and reliability that parents trust.

Strong eCheck/ACH Support: Ideal for reducing transaction costs on large semester or annual tuition payments.

Cons:

Complex Pricing: Fees can vary significantly based on your reseller or merchant account provider, and a monthly fee is required.

Slower Setup: The setup process often involves a merchant account application, which is less "instant" than modern competitors.

Website: https://www.authorize.net/resources/our-features/invoicing.html

6. Adyen

Adyen is an enterprise-grade payment platform designed for large-scale operations, making it one of the top payment gateways for tutoring centers with multi-location franchises or significant international student bases. Unlike simpler platforms, Adyen acts as a direct acquirer, processor, and gateway in one, giving businesses more control over the payment flow. It is built for tutoring networks that require a unified system to handle diverse local payment methods across different countries.

The platform's strength lies in its single integration that unlocks global payment capabilities. For a language school franchise operating in Europe, Asia, and North America, Adyen can process iDEAL in the Netherlands, GrabPay in Southeast Asia, and standard credit cards in the US, all through one backend. Its advanced risk management and data-driven authorization are crucial for organizations processing high volumes of transactions.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Interchange++ pricing. A fixed processing fee (e.g., €0.12) plus fees from the card scheme and acquiring bank. |

Subscription Tools | Robust recurring payment and tokenization features suitable for enterprise-level subscription models. |

Payout Timing | Flexible and configurable payout schedules based on business needs and sales cycles. |

Supported Currencies | Supports all major currencies and a vast array of local payment methods globally. |

Integration | Requires developer involvement for API integration; not a plug-and-play solution for small businesses. |

Pros:

Superior Global Coverage: A single platform for accepting payments from nearly every country and local method.

Optimized Performance: Data-driven tools significantly improve authorization rates for high-volume centers.

Unified Commerce: Consolidates online, in-person, and mobile payments into one system for franchises.

Cons:

High Volume Requirement: Best suited for businesses processing millions in annual revenue; not for small centers.

Complex Onboarding: Setup is more involved than with platforms like Stripe and requires direct sales engagement.

Website: https://www.adyen.com/pricing

7. Checkout.com

Checkout.com is a modern, cloud-based payment platform designed for global businesses, making it an excellent choice for tutoring enterprises with multi-region operations. Unlike more straightforward gateways, Checkout.com acts as both a gateway and a processor, providing rich data and deep analytics on payment performance. This unified approach is ideal for large tutoring franchises or online learning platforms looking to optimize revenue across different countries.

The platform’s strength lies in its unified API that supports over 150 currencies and a vast array of local payment methods. For a tutoring center expanding into Europe or Asia, this means you can offer familiar payment options like iDEAL or Sofort without complex integrations. Its powerful reporting tools allow operations managers to easily reconcile payments from multiple branches or currencies.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Custom pricing based on volume and business model. Offers flat-rate or Interchange++ pricing after sales consultation. |

Subscription Tools | Robust API allows developers to build custom subscription logic for tuition plans and recurring billing. |

Payout Timing | Flexible and configurable settlement schedules based on your business needs and geography. |

Supported Currencies | 150+ processing currencies and numerous local payment methods worldwide. |

Integration | API-first platform designed for custom development. Less plug-and-play than competitors like Stripe or PayPal. |

Pros:

Enterprise-Grade Performance: Highly reliable and scalable, built for large-scale operations and international transactions.

Powerful Analytics: Provides granular data on payment acceptance rates, helping to optimize revenue and reduce declines.

Flexible Pricing Models: Can offer more competitive rates for high-volume centers compared to standard flat-rate pricing.

Cons:

Requires Technical Resources: Best suited for tutoring businesses with access to developers to leverage its powerful API.

No Public Pricing: You must engage with their sales team to get a quote, which is less ideal for smaller centers.

Website: https://www.checkout.com/pricing

8. Worldpay (from FIS)

For large, multi-location tutoring networks or tech-savvy centers running proprietary management software, Worldpay offers a powerful, embedded payment solution. Rather than just being a simple gateway, it allows a tutoring business to become its own payment facilitator (PayFac). This is ideal for franchise models that want to centralize payment processing and standardize fees across branches.

This model transforms payments from a simple utility into a core part of your business infrastructure. It provides the tools to manage a complex portfolio of sub-accounts (e.g., individual franchise locations), set custom transaction fees, and oversee risk from a central dashboard. While it represents a significant step up in complexity, it offers unmatched control for large-scale operations looking to build a seamless, branded payment experience.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Custom pricing. Not publicly available and requires direct sales consultation. |

Subscription Tools | Robust APIs and tools for creating and managing recurring billing plans tailored to platform needs. |

Payout Timing | Configurable payout schedules based on the chosen PayFac model and risk assessment. |

Supported Currencies | Extensive global currency and payment method support, designed for international platforms. |

Integration | Designed for deep, API-driven integration into custom software platforms (PayFac-as-a-Service). |

Pros:

Monetization Potential: Flexible models allow tutoring networks to share in payment revenue and set their own fee structures.

Ultimate Control: Provides complete command over the payment experience, branding, and onboarding for sub-accounts.

Scalability & Compliance: Built to handle high transaction volumes with strong risk and compliance support for platform models.

Cons:

Significant Complexity: This is not a plug-and-play solution and requires substantial technical and operational investment.

Opaque Pricing: All pricing is negotiated, making it difficult to estimate costs without a formal sales process.

Overkill for Most Centers: Far too complex for single-location tutoring businesses or those without custom software.

Website: https://platforms.worldpay.com/

9. Helcim

Helcim distinguishes itself by offering interchange-plus pricing, a highly transparent model that can significantly lower costs for tutoring centers processing a steady volume of transactions. Instead of a flat rate, you pay the direct wholesale cost of a transaction plus a small, fixed margin. This structure makes it one of the most cost-effective payment gateways for tutoring centers focused on maximizing every dollar.

The platform comes with a suite of built-in tools at no extra cost, including invoicing, recurring payment plans, and hosted payment pages. This is a major advantage for centers that need subscription and invoicing features without paying extra for them. Helcim is an excellent fit for growing tutoring businesses that want predictable costs without sacrificing essential functionality. This clear pricing model also helps when you need to determine how much to charge for tutoring services by making your operational costs easier to forecast.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | Interchange + 0.50% and 25¢ for online card payments. In-person is Interchange + 0.30% and 8¢. ACH is 0.5% + 25¢. |

Subscription Tools | Built-in recurring billing and subscription management included at no additional cost. |

Payout Timing | Standard payouts in 1-2 business days. |

Supported Currencies | Primarily focused on USD and CAD transactions. |

Integration | Offers a solid API and pre-built integrations. Best for custom-built sites or using its hosted payment pages. |

Pros:

Transparent Pricing: Interchange-plus model can lead to significant savings as your processing volume grows.

No Hidden Fees: Zero monthly fees, no PCI compliance fees, and no setup costs.

Included Business Tools: Free access to invoicing, recurring payments, and a virtual terminal adds tremendous value.

Cons:

Complex Rate Structure: Interchange pricing is harder to predict than flat-rate, as fees vary by card type.

Hardware is Extra: While reasonably priced, physical terminals for in-person payments are an additional cost.

Website: https://www.helcim.com/pricing/

10. GoCardless

GoCardless offers a specialized approach to payments that makes it a strategic addition for tutoring centers, particularly those managing predictable, recurring tuition fees. Instead of processing credit cards, it focuses exclusively on bank-to-bank payments through ACH debit. This method is ideal for automating monthly subscriptions or semester-long payment plans, as it pulls funds directly from a parent’s bank account. This significantly reduces transaction fees and nearly eliminates chargebacks.

The platform is designed to complement your existing card processor, not replace it. You can use GoCardless for committed, long-term students on recurring plans while offering credit card payments for one-off lessons. It excels with its automated tools for handling payment failures, including intelligent retries (Success+), and integrates with over 350 accounting platforms like Xero and QuickBooks. This makes reconciliation for tuition payments incredibly simple.

Key Features & Pricing

Feature | Details |

|---|---|

Transaction Fees | 1% + 25¢ per transaction for domestic ACH debit, capped at $10. International payments cost more. |

Subscription Tools | Robust features for creating and managing recurring payment plans and one-off invoices via bank debit. |

Payout Timing | Payouts arrive 2 business days after payment collection. |

Supported Currencies | Collect payments from over 30 countries, including the US, UK, Canada, Australia, and the Eurozone. |

Integration | Strong API and over 350 direct integrations with accounting and business software. |

Pros:

Lower Transaction Costs: Significantly cheaper than card processing for recurring tuition payments.

Reduced Chargeback Risk: Bank-authorized mandates make disputes far less common than with credit cards.

High Payment Success Rate: Automated retries and bank verification help ensure payments are collected on time.

Cons:

Not a Card Processor: It only handles bank payments, so you'll need another gateway for card acceptance.

Slower Initial Setup: Parents must complete a one-time authorization (mandate) for their bank account.

Website: https://gocardless.com/en-us/pricing/

Top 10 Payment Gateways for Tutoring Centers — Comparison

Product | Best For | Key Feature | Integration & UX | Pricing Model |

|---|---|---|---|---|

Stripe | Centers needing flexibility and automation | Deep integration, recurring billing, global payments | Developer-friendly APIs, connects to Tutorbase | 2.9% + 30¢ (online cards) |

PayPal | Quick setup and high parent trust | Familiar checkout, Venmo & Pay Later options | Easy plug-and-play widgets | 3.49% + 49¢ (online) |

Braintree | Multi-brand groups with custom portals | Unified card, PayPal, and Venmo acceptance | API-driven, more technical setup | 2.59% + 49¢ (cards) |

Square | Hybrid centers with in-person payments | All-in-one POS hardware and online invoicing | Simple to deploy, user-friendly interface | 2.6% + 10¢ (in-person) |

Authorize.Net | Centers with existing merchant accounts | Strong eCheck/ACH support, works with many banks | Broad support, requires merchant account | $25/month + transaction fees |

Adyen | Large, international tutoring franchises | Unified global payment methods, optimized rates | Enterprise-level API, requires developer resources | Custom Interchange++ |

Checkout.com | Multi-region centers needing deep analytics | Global processing with powerful reporting | API-first, requires technical team | Custom, volume-based |

Worldpay | Franchise networks building custom platforms | Embedded payments (PayFac model) | Deep API integration for platform models | Custom, sales-led |

Helcim | Cost-conscious centers seeking transparency | Interchange-plus pricing, no monthly fees | Straightforward setup with included tools | Interchange + fixed margin |

GoCardless | Automating recurring tuition via bank debit | Low-cost ACH payments, reduced chargebacks | API connects to accounting software | 1% + 25¢ (capped at $10) |

How to Automate Payments and Scale Your Operations

Choosing the right payment gateway is a critical decision that impacts your tutoring center's cash flow, administrative workload, and ability to scale. As we've explored, the landscape of payment processing is diverse. Solutions like Stripe offer unparalleled developer tools and seamless integration with platforms like Tutorbase, making it the top choice for most growing centers. PayPal and Square provide simplicity, ideal for new businesses prioritizing quick setup.

For centers with more complex needs, such as multi-branch operations, processors like Adyen and Checkout.com present powerful, unified platforms. Meanwhile, providers like Helcim appeal to budget-conscious owners with its transparent pricing, and GoCardless offers a cost-effective solution for businesses reliant on recurring bank debits. Your final choice will depend on your specific operational model, transaction volume, and growth ambitions.

From Payment Processing to Business Automation

However, selecting a payment gateway is only the first step. The true operational leap comes from integrating it into a comprehensive tutoring management system. A standalone gateway still leaves you with the manual tasks of creating invoices, chasing payments, updating student ledgers, and reconciling accounts. This is where the administrative bottleneck forms.

The goal is to move beyond simple payment collection and achieve full financial automation. This means connecting attendance directly to invoicing, invoicing to payment processing, and payments back to your financial reports and payroll. When these systems are linked, the workflow is seamless. For instance, a teacher marks attendance, which automatically generates an invoice that is paid via an integrated portal, and the teacher's corresponding payroll is calculated accurately. This level of automation is what transforms a tutoring center from a manually run operation into a scalable business. You can explore resources on effective payment provider integration to understand the technical foundations.

Key Considerations for Implementation

Before you commit, consider these final implementation factors:

Total Cost of Ownership: Look beyond the advertised transaction fees. Factor in monthly fees, chargeback costs, and the administrative hours you will save.

Parent Experience: The payment process is a key customer touchpoint. A clunky experience can lead to frustration and churn. Make it easy for parents to pay online, set up recurring billing, or view their payment history.

Integration is Non-Negotiable: Your payment gateway should not be an island. Prioritize a solution that integrates natively with your core management software. This eliminates duplicate data entry and reduces human error.

Scalability: The gateway that works for you today with 50 students might not be the right fit at 500. Choose a partner that can grow with you, supporting higher transaction volumes, prepaid credits, and subscriptions.

Ultimately, automating your payment workflow is about reclaiming your time. By making the right choice, you lay the financial foundation for sustainable growth, allowing you to focus less on administrative drag and more on what you do best: delivering exceptional education.

Frequently Asked Questions (FAQ)

What is the cheapest payment gateway for a tutoring center?

For recurring tuition, GoCardless is often the cheapest due to its low, capped fees for ACH bank debits. For credit card processing, Helcim's interchange-plus pricing model can be the most cost-effective for centers with steady transaction volume, as it avoids the higher markups of flat-rate providers.

Can I use more than one payment gateway?

Yes, many tutoring centers use multiple gateways. A common strategy is to use a primary processor like Stripe for credit card payments (for flexibility and new sign-ups) and a secondary one like GoCardless for lower-cost, recurring ACH payments from long-term students.

How does a payment gateway handle recurring billing for tuition?

Most top payment gateways offer subscription or recurring billing tools. You can set up automated payment plans (e.g., weekly, monthly, per semester) where the system automatically charges a parent's saved card or bank account on a schedule. This eliminates the need for manual invoicing and payment chasing each cycle.

Do I need a merchant account to use a payment gateway?

Not always. Modern payment service providers (PSPs) like Stripe, PayPal, and Square combine the merchant account and payment gateway into one service, simplifying the setup process. Traditional gateways like Authorize.Net typically require you to have a separate merchant account with a bank.

How do payment gateways integrate with tutoring management software like Tutorbase?

Payment gateways integrate with software like Tutorbase via an API (Application Programming Interface). This allows the two systems to communicate securely. When integrated, you can automatically generate invoices from lesson attendance, send payment links to parents, and reconcile payments directly within your management dashboard, which saves over 10 hours of admin work per week.

Ready to eliminate 10+ hours of weekly admin and automate your entire billing cycle? Tutorbase integrates directly with leading payment gateways like Stripe to turn attendance into paid invoices and accurate payroll, seamlessly. Stop chasing payments and start scaling your tutoring center.

More from the Blog

12 Top Tutoring Software for Franchise Owners in 2026

Read Article

Read Article

12 Top Tutoring Software for Franchise Owners in 2026

Read Article

Read Article

The Top 10 Payment Gateways for Tutoring Centers in 2026: A Complete Guide

Read Article

Read Article

The Top 10 Payment Gateways for Tutoring Centers in 2026: A Complete Guide

Read Article

Read Article

12 Best Online Booking Systems for Tutors in 2026: An In-Depth Review

Read Article

Read Article

12 Best Online Booking Systems for Tutors in 2026: An In-Depth Review

Read Article

Read Article