Key Takeaway: Understanding tax deductions is crucial for maximizing your tutoring center's profitability. This guide explains how to deduct operational costs like software, workspace expenses (including home office), travel mileage, payroll, and professional development to significantly lower your taxable income.

This guide will turn your everyday business costs, from whiteboard markers to your monthly Tutorbase subscription, into real savings come tax time.

What Are Tutoring Business Tax Deductions?

Whether you're a solo tutor or running a multi-branch tutoring center, you spend money to help students succeed. Tax authorities in the US, UK, and Australia let you subtract these business costs from your revenue before calculating your tax bill. This means you’re only taxed on your actual profit, not your total income.

Every dollar you spend on a valid business expense is a dollar that isn't taxed. For a growing tutoring business, this can easily add up to thousands of dollars in savings each year. That's cash you can reinvest into hiring great tutors, upgrading your technology, or launching a new marketing campaign.

What Makes an Expense Deductible?

An expense is deductible if it is both ordinary and necessary for your tutoring business.

- Ordinary: The expense is common and accepted in the tutoring industry. This includes curriculum subscriptions, student workbooks, or advertising your services. These are standard costs of doing business.

- Necessary: The expense is helpful and appropriate for running your business. While you could manage scheduling with spreadsheets, using software like Tutorbase is a necessary tool for operating efficiently and preventing costly booking errors.

Understanding these two principles helps you spot and track potential write-offs all year long. For a broader overview, this guide on small business tax deductions is a useful resource.

Common Deductions for Tutors: A Quick Guide

Here is a look at the most frequent tax write-offs for tutors and tutoring centers. This table is your starting point for identifying savings opportunities in your own business operations.

| Common Tax Deductions for Tutoring Businesses |

|---|

| Deduction Category & Examples |

| Operational Costs: Tutoring management software (like Tutorbase), student workbooks, printing costs, website hosting fees, online learning platform subscriptions. |

| Workspace Expenses: Rent for a commercial center, a portion of home utilities for a home office, property insurance, and furniture like desks and chairs. |

| Marketing & Advertising: Social media ad campaigns, local newspaper ads, printed flyers, business cards, and fees for listing on tutor directories. |

| Professional Development: Fees for SAT prep certification courses, industry conferences, subscriptions to educational journals, and training on new teaching methods. |

| Travel & Mileage: The mileage driven to a student's home for an in-person session, travel between different tutoring branches, or trips to buy supplies. |

| Payroll & Contractor Fees: Gross wages for W-2 employees, employer's share of payroll taxes, and fees paid to 1099 independent contractors. |

How to Deduct Your Operational Costs

Operational costs are the everyday expenses you pay to deliver your services. Every dollar spent on curriculum licensing, website hosting, or even whiteboard markers is a potential tax deduction that directly lowers your taxable income.

Busy tutoring centers using Tutorbase often manage 50 to 10,000+ lessons per week. The administrative burden is immense, but smart owners know that tax deductions on operational costs can reclaim thousands of dollars. In 2024, self-employed tutors can write off a huge range of these "ordinary and necessary" expenses.

Essential Teaching Materials and Supplies

The most straightforward deductions are the physical and digital materials you use for teaching. These are the tools of your trade, and their costs are fully deductible as long as they are for business use.

Common examples include:

- Student Resources: Workbooks, textbooks, practice test booklets, and flashcards.

- Classroom Supplies: Whiteboards, markers, pens, paper, printers, and ink cartridges.

- Learning Aids: Educational games, math manipulatives, or science models for STEM subjects.

You must keep every receipt for these purchases. These small costs add up to a significant deduction over a full year.

Technology and Software Subscriptions

Technology is a core part of running a modern tutoring business. The software and digital tools you use to manage operations and deliver lessons are essential expenses and, therefore, deductible. This category is a goldmine for write-offs.

Your deductible tech costs include:

- Management Platforms: Your subscription to a system like Tutorbase is a key business expense, necessary for scheduling, billing, and payroll.

- Communication Tools: Fees for video conferencing software like Zoom or Google Meet used for online or hybrid classes.

- Online Curriculum: Subscriptions to digital learning resources or interactive educational platforms.

- Administrative Software: Costs for accounting software, email marketing services, and cloud storage.

Marketing and Advertising Expenses

You cannot teach students you don't have. Every expense related to finding new clients and promoting your tutoring services is a valid business deduction. These costs are necessary for growth and maintaining a steady student pipeline.

Typical marketing deductions for a tutoring business include:

- Digital Advertising: Money spent on ads on platforms like Facebook, Instagram, or Google.

- Website Costs: Fees for website hosting, domain name registration, and any plugins or themes.

- Printed Materials: The design and printing costs for business cards, flyers, brochures, and banners.

- Directory Listings: Fees paid to be listed on online tutor directories or local business websites.

Tracking these operational expenses is key. Use a separate business bank account to make purchases easy to identify and keep digital copies of all invoices and receipts.

How to Write Off Workspace and Travel Expenses

Your tutoring space, whether a commercial center or a dedicated home office, is a major business asset with significant tax advantages. The same applies to travel for business purposes, from visiting students to picking up supplies.

For tutoring centers leasing a commercial space, the expenses are clear. Nearly every cost tied to running your physical location is fully deductible as a necessary cost of doing business.

This includes:

- Monthly Rent: The full amount you pay to lease your commercial space.

- Utilities: All essentials, like electricity, heat, water, and business internet.

- Insurance: Premiums for your center’s business liability or property insurance.

- Maintenance and Repairs: The costs of keeping your center in good shape, from cleaning services to facility repairs.

The Home Office Deduction: What Tutors Need to Know

The home office deduction is one of the most powerful write-offs for independent tutors. To claim it, your workspace must pass the IRS's "exclusive and regular use" test. This means the space must be used exclusively for your tutoring business and on a regular basis. A spare bedroom used only for student sessions and business admin qualifies perfectly.

You have two ways to calculate your deduction.

The Simplified Method

This is the no-fuss option. You can deduct $5 per square foot of your dedicated office space, up to a maximum of 300 square feet. This gives you a maximum deduction of $1,500 per year. It is quick and requires minimal paperwork.

The Actual Expense Method

This method takes more work but can lead to a much larger deduction. You calculate the percentage of your home used for business. For example, if your home is 2,000 square feet and your office is 200 square feet, your business use is 10%. You can then write off 10% of your actual home expenses.

Deductible expenses include:

- Rent or mortgage interest

- Homeowners' insurance

- Utilities (electricity, gas, water)

- Home repairs and maintenance

- Property taxes

Turning Your Car into a Tax Write-Off

Travel is another huge category of deductible expenses. The rule is that the travel must be for business, not your daily commute. If you drive from your home office to a student's house for a lesson, that mileage is deductible.

The easiest way to track this is with the standard mileage rate. For 2024, the IRS lets you deduct 67 cents per mile driven for business. You must keep a detailed log of your trips, including the date, purpose, starting and ending locations, and total miles.

Deductible travel includes driving to:

- A student's home for an in-person lesson.

- Different tutoring center branches you operate.

- The store to buy teaching supplies or curriculum materials.

- A local workshop or professional development conference.

A meticulous log, either in a notebook or with a mileage tracking app, is non-negotiable proof for this deduction.

How to Claim Payroll and Professional Development Costs

Your people are your greatest asset. The costs associated with your staff and your own professional growth are a goldmine for tax deductions. These are investments in the quality of your service, and the tax code allows you to write them off.

Handling Employee and Contractor Payments

If you have W-2 employees, you can deduct their gross wages, your share of payroll taxes (Social Security and Medicare), unemployment insurance, and contributions to their health insurance or retirement plans.

For independent tutors hired as 1099 contractors, you can fully deduct the fees you pay them for their services. You don't handle their payroll taxes; you pay their fee and report it on a Form 1099-NEC if it's $600 or more in a year. Using a dedicated tutor payroll software prevents errors by accurately tracking payments for both W-2 employees and 1099 contractors.

W-2 Employees vs. 1099 Contractors: What Can You Deduct?

| Expense Type | Deductible for W-2 Employees | Deductible for 1099 Contractors |

|---|---|---|

| Gross Wages/Salaries | Yes - The full amount paid to the employee. | N/A - Contractors are not paid wages. |

| Contractor Fees | N/A - Employees do not receive contractor fees. | Yes - The full amount paid for services. |

| Employer's Share of Payroll Taxes | Yes - Your FICA (Social Security & Medicare) contributions. | No - Contractors pay their own self-employment taxes. |

| Unemployment Insurance | Yes - FUTA and SUTA taxes you pay. | No - Contractors are not eligible. |

| Employee Benefits | Yes - Health insurance, retirement plan contributions. | No - You do not provide benefits to contractors. |

| Workers' Compensation Insurance | Yes - Premiums for employee coverage are deductible. | Typically No - Varies by state, but generally not required. |

Keeping clear records for each worker type is essential for maximizing your write-offs.

Investing in Professional Development

Your expertise is what clients pay for, so money spent to sharpen your skills is a deductible business expense. This applies to solo tutors learning new curricula and center owners funding staff training.

Common professional growth costs you can write off include:

- Training and Certifications: A course to get certified in SAT, IELTS, or DELF test prep is deductible because it directly improves your services.

- Industry Conferences: Registration fees, flights, and hotel costs for attending an education conference are deductible.

- Subscriptions and Memberships: Dues for professional teaching organizations or subscriptions to educational journals are valid write-offs.

- Continuing Education: Any workshop or seminar that makes you a better teacher or a smarter business owner qualifies.

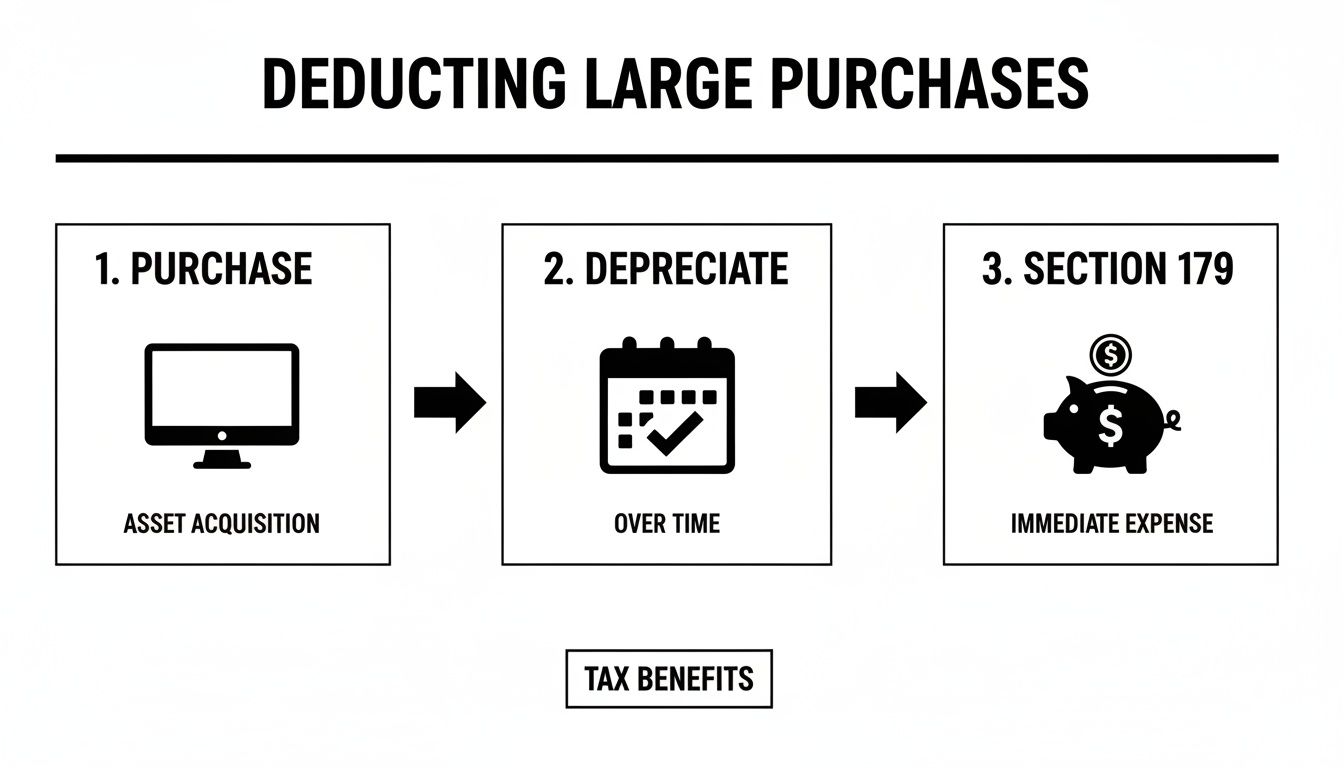

Deducting Large Purchases and Growth Expenses

Large purchases are capital expenses, which are significant investments in equipment you'll use for more than a year. A new set of laptops, an interactive smartboard, or furniture for a new location are all capital expenses. Typically, you depreciate them, deducting a portion of the cost each year over the item's "useful life."

The U.S. online tutoring market is projected to hit $1.8 billion by 2025, with nearly 19,881 firms competing, according to the financial landscape of the tutoring industry on IBISWorld. This growth means staying competitive often requires significant investment.

The Power of Section 179

Section 179 of the U.S. tax code lets eligible businesses deduct the full purchase price of qualifying equipment in the same tax year they begin using it. Instead of slowly depreciating new computers over five years, Section 179 may let you write off the entire expense now. This can dramatically lower your taxable income for the year, freeing up cash to reinvest in the business.

Other Key Deductions for Growth

Major equipment purchases are not the only large expenses that come with growth. These other crucial costs are also fully deductible in the year you pay them.

Don't forget to deduct these essentials:

- Business Insurance: General liability, professional liability, and property insurance premiums are necessary and fully deductible.

- Professional Fees: Money paid to an accountant for tax preparation, a lawyer to review a lease, or a consultant for business strategy is all deductible.

- Interest on Business Loans: If you took out a loan for expansion, equipment, or cash flow, the interest paid on that loan is a deductible expense.

How to Master Your Record-Keeping for Tax Season

Claiming tax deductions is one thing; proving them is another. Solid record-keeping is your best defense against an audit and the key to claiming every write-off you’re entitled to. The first step is to separate your business and personal finances with a dedicated business bank account.

Essential Documents to Keep

Your goal is to have undeniable proof for every deduction. A credit card statement alone is often not enough; you need detailed receipts.

Here’s a list of what you should always keep:

- Receipts and Invoices: Keep digital or physical copies of every business purchase. Use digital receipt management tools like smartreceipts to simplify tracking.

- Bank and Credit Card Statements: These provide a high-level overview of your business account's cash flow.

- Mileage Logs: A detailed logbook or app data is required to deduct business driving.

- Payroll Records: You must keep meticulous records of salaries, taxes paid, and any benefits contributions for all staff.

This flowchart breaks down how to handle large purchases, from acquisition to applying tax strategies like depreciation or Section 179.

As you can see, large expenses are strategic assets with specific tax treatments that can significantly reduce what you owe this year.

How Tutoring Software Creates a Perfect Audit Trail

Manually tracking every transaction is an administrative burden, especially for a busy tutoring center. This is where dedicated tutoring management software becomes your secret weapon for tax compliance.

Platforms like Tutorbase are designed to create a clean, digital paper trail automatically. By managing scheduling, invoicing, payments, and payroll in one place, the software generates organized financial data in real time. Every lesson is linked to an invoice, every payment is recorded, and every tutor’s pay is calculated, creating a verifiable record of your income and key expenses. For a deeper dive, you can learn more about integrating with QuickBooks Online in our article.

FAQ: Tutoring Business Tax Deductions

Can I deduct my college tuition if I plan to become a tutor?

No, you generally cannot deduct the costs of your initial college degree. The IRS considers this a personal expense required to qualify for your career. However, once you are an operating tutor, any professional development that maintains or improves your existing skills, such as an advanced certification course, is deductible.

What is the best way to track my business mileage?

The easiest and most accurate method is using a mileage-tracking app on your phone. These apps use GPS to automatically log trips, allowing you to classify them as business or personal. If you prefer a manual method, a detailed logbook or spreadsheet is acceptable. For every business trip, record the date, purpose, start/end locations, and total miles.

How does tutoring software help with tax deductions?

Tutoring management software provides a dual tax benefit. First, the subscription fee itself is 100% deductible as a necessary business expense. Second, it automates record-keeping by creating a clean, central record of your income and major expenses. By tracking lesson attendance, generating invoices, and processing payroll, it builds a digital audit trail that simplifies tax preparation.

Do I need an accountant for my tutoring business?

While not legally required, hiring a tax professional is a strategic move that often pays for itself, especially as your business grows. An accountant specializing in small businesses can identify deductions you might miss, like Section 179, ensure compliance with payroll tax laws, and help structure your business for maximum tax efficiency.

Can I deduct the cost of setting up my business website?

Yes, the costs associated with creating and maintaining your business website are fully deductible. This includes expenses like domain registration fees, web hosting services, theme or plugin purchases, and payments to a web designer or developer. These are considered marketing and advertising expenses necessary to promote your business.

Ready to stop wasting hours on admin and start building a more profitable tutoring business? Tutorbase consolidates your scheduling, billing, and payroll into one smart platform, giving you the organized financial data you need to maximize your tax deductions effortlessly. See how Tutorbase can simplify your business operations.