Deciding whether your tutors are employees or independent contractors boils down to one critical factor: control. If you dictate how, when, and where a tutor works, they are an employee. If they operate with genuine independence, they are a contractor. This choice fundamentally shapes your costs, legal risks, and day-to-day operations.

The Core Decision For Your Tutoring Center: Employee Or Contractor?

Choosing whether to bring tutors on as W-2 employees or engage them as 1099 independent contractors is one of the most significant strategic moves a tutoring center owner can make. This is not just about payroll; it is a foundational decision that impacts your financial obligations, operational flexibility, and legal compliance.

Misclassifying workers can lead to severe penalties from tax authorities and labor departments, including back taxes, hefty fines, and painful legal fees. This decision demands careful consideration of the legal frameworks that govern worker status in 2024.

Understanding The Legal Framework

Government agencies use specific tests to determine a worker's true status, focusing primarily on the degree of control you exercise. A key standard in a growing number of U.S. states is the "ABC test," which presumes a worker is an employee unless the business can prove all three of the following conditions:

- A: The tutor is free from your control and direction in how they perform their work.

- B: The tutoring they provide is outside the usual course of your business.

- C: The tutor is customarily engaged in an independently established trade, occupation, or business (like running their own tutoring service).

For most tutoring centers, prong 'B' is a significant hurdle. Since tutoring is your core business, passing this test is extremely difficult. Understanding the precise definitions for an employee or independent contractor classification is the first step toward compliance.

The employee model grants you high control, which is ideal for delivering a standardized, branded experience. In contrast, the contractor model provides flexibility and lower overhead but requires you to give up direct oversight of teaching methods.

Quick Comparison: Employee Vs. Independent Contractor in Tutoring

| Factor | Employee | Independent Contractor |

|---|---|---|

| Control | Center dictates schedule, methods, and curriculum. | Tutor sets their own schedule and uses their own methods. |

| Taxes | Center withholds income, Social Security, and Medicare taxes. | Tutor is responsible for their own self-employment taxes. |

| Benefits | Eligible for benefits like health insurance, retirement plans. | Not eligible for company benefits. |

| Financial Risk | Lower financial risk for the tutor. | Higher financial risk and responsibility for the tutor. |

| Cost to Center | Higher cost due to payroll taxes and potential benefits. | Lower direct cost, typically paid a higher hourly rate. |

| Tools & Materials | Center provides necessary equipment and materials. | Tutor uses their own equipment and materials. |

| Training | Center provides and requires specific training. | Operates independently without required company training. |

With employees, you pay more for control and consistency. With contractors, you save on direct overhead but lose the ability to manage the "how" of their work.

Analyzing The True Financial Impact Of Each Model

When comparing the employee vs. independent contractor models, the financial analysis goes much deeper than the hourly rate. Contractors often appear cheaper initially, but a true cost-benefit analysis must account for the fully-loaded cost of an employee and the indirect expenses of managing contractors.

An employee’s base pay is just the starting point. The actual cost includes additional expenses that can add 20% to 30% on top of their wages. These are not optional; they are legally required contributions and standard business costs.

The Hidden Costs Of W-2 Employees

Hiring employees introduces predictable, recurring costs that extend beyond their hourly wage. Failing to account for these mandatory expenses in your financial model can lead to a significant miscalculation of your true payroll burden.

Key additional costs for employees include:

- Payroll Taxes: You are responsible for the employer's share of Social Security (6.2%) and Medicare (1.45%) taxes.

- Unemployment Insurance: You must pay both federal (FUTA) and state (SUTA) unemployment taxes.

- Workers' Compensation Insurance: This is mandatory in most states and covers medical bills and lost wages for on-the-job injuries.

- Benefits Packages: If you offer health insurance, retirement plans, or paid time off, these become significant direct costs.

These costs add up. For a tutor earning $50,000 annually, you can expect to pay an additional $10,000 to $15,000 in taxes and insurance before considering optional benefits.

The Financial Case For Independent Contractors

The contractor model appears financially straightforward: you agree on a rate, pay for services, and you are done. There are no payroll taxes, unemployment contributions, or benefits to administer. This simplicity is a major advantage for many center owners.

Classifying tutors as independent contractors can lead to savings of 15% to 25% on payroll expenses. For a center with 20 tutors averaging $30/hour for 20 hours a week, a 20% savings could mean $124,800 in reduced costs annually.

However, this model has its own financial considerations. Independent contractors typically command higher hourly rates to cover their self-employment taxes, lack of benefits, and business costs. Tutors need to manage their own financial protection, making resources on insurance for independent contractors essential for them.

The contractor model significantly reduces direct payroll overhead. This is often balanced by higher hourly rates, since the tutor must cover their own taxes, insurance, and business expenses.

Modeling The Financial Difference

Let's walk through a practical example for a tutor working 20 hours per week.

- Employee Scenario: You hire a tutor at $25/hour. Your fully-loaded cost, after adding an estimated 25% for taxes and insurance, becomes $31.25/hour.

- Contractor Scenario: You engage a contractor who charges $35/hour. Their rate is higher to cover their self-employment taxes and overhead.

In this case, the contractor is more expensive per hour. However, if their rate were $30/hour, you would save $1.25 hourly. Multiplied across several tutors and thousands of hours, these savings become substantial. Learn more by reading our guide on how much tutors get paid.

Navigating The Legal Risks Of Tutor Misclassification

Misclassifying a tutor is not a minor administrative error. It is a high-stakes legal and financial risk that can threaten your entire tutoring center. Agencies like the IRS and the Department of Labor (DOL) aggressively enforce the distinction between employees and independent contractors. A single mistake can trigger an audit, leading to massive fines and back taxes.

Your best defense is a thorough understanding of the legal tests regulators use to define a worker's status. These are the standards by which your business will be judged.

The Major Legal Tests Explained

Regulators use several key frameworks to analyze the relationship between your center and its tutors. While the specifics vary, they all center on one question: how much control does the business exert over the worker?

The Common Law Test: This is the IRS standard. It focuses on the "right to control" across three areas: behavioral control (how, when, and where tutors work), financial control (how they are paid and who covers expenses), and the nature of the relationship (benefits, contracts).

The Economic Realities Test: Used by the DOL, this test assesses if a worker is economically dependent on your business. If a tutor relies solely on your center for income, they are likely an employee.

The ABC Test: This is the strictest test, and its adoption is growing. To classify a tutor as an independent contractor, you must prove all three conditions are met. Failing even one means the worker is legally considered an employee.

The ABC Test Breakdown A. The worker is free from the control and direction of the hiring entity. B. The work is outside the usual course of the hiring entity’s business. C. The worker is customarily engaged in an independently established trade, occupation, or business.

For nearly every tutoring center, prong B is the dealbreaker. Tutoring is your core business, making it almost impossible to argue that your tutors are doing work "outside the usual course" of your operations.

Real-World Consequences and Red Flags

The penalties for misclassification are severe. In 2024, the risk is heightened as regulations tighten. A 2023 study revealed that 25% of audited ed-tech firms faced penalties averaging $50,000 per 10 workers. With nearly 70% of U.S. states using strict tests that presume employee status, the compliance landscape is more challenging than ever. You can read more from the experts at Telios Law.

Audits are often triggered by operational red flags. You are inviting scrutiny if you do any of the following with 1099 tutors:

- Requiring tutors to use a specific curriculum or teaching method.

- Setting mandatory work hours or fixed schedules.

- Providing extensive training on how to tutor.

- Prohibiting tutors from working with other clients or companies.

- Supplying all teaching materials, software, and equipment.

Key Legal And Compliance Differences

Your contracts and daily operations must be aligned. A well-written contract is critical, but your actions must support it. We cover this in our guide on tutoring contract templates and best practices.

This table breaks down core compliance responsibilities. Use it to ensure your practices align with your chosen model.

| Compliance Area | Employee Model Responsibility | Independent Contractor Model Responsibility |

|---|---|---|

| Tax Withholding | Center withholds FICA, federal, and state income taxes. Issues a W-2 form. | Tutor is responsible for their own self-employment taxes. Center issues a 1099-NEC. |

| Benefits & Insurance | Center provides workers' compensation and may offer health insurance, PTO, etc. | Tutor is responsible for their own health insurance and other benefits. |

| Tools & Equipment | Center provides all necessary materials, software, and physical workspace. | Tutor uses their own laptop, software, and teaching materials. |

| Scheduling & Availability | Center sets a fixed schedule and dictates work hours for tutors. | Tutor provides their availability and has the right to accept or decline assignments. |

| Training & Methods | Center mandates specific training programs and teaching methodologies. | Tutor uses their own professional expertise and methods to achieve results. |

Staying compliant requires a proactive and honest assessment of your operations. The financial appeal of the contractor model must be weighed against the significant legal risk of misclassification.

How Hiring Models Impact Operational Control And Workflows

Your choice between an employee and a contractor directly shapes the daily rhythm of your business. It dictates how you schedule lessons, control curriculum, and maintain educational quality. At its core, this is a trade-off between control and autonomy.

With employees, you can standardize everything. You set work hours, mandate teaching methodologies, and require participation in professional development. This control is essential for centers that build their reputation on a consistent student experience.

For example, a test prep center with a proprietary SAT strategy needs employees who follow prescribed lesson plans to ensure every student receives the same proven method.

Scheduling Workflows: Employee Vs. Contractor

The difference in scheduling is one of the most immediate operational impacts. Managing employees means building a schedule to fit your business needs. Working with contractors means adapting to their availability.

- Employee Scheduling: You build the schedule around your center's peak hours. You can assign tutors to specific shifts and require their presence for parent meetings or administrative tasks. This provides predictable capacity and simplifies booking.

- Contractor Scheduling: You adapt to the contractor's availability. They provide their open times, and you fill those slots. While less predictable, this model offers access to specialized tutors who are not seeking full-time employment.

Does your business model require tutors to be available when you need them, or can you adapt to when they are available? The answer often points to the correct hiring model.

Maintaining Quality And Consistency

Your level of control directly impacts service quality. Employees can be trained to become brand ambassadors, from how they greet parents to the specific feedback they provide.

Independent contractors, by law, must be free to use their own methods. You can set expectations for results, but you cannot dictate the process they use. This can lead to a less uniform, though potentially more diverse, teaching environment.

A tutoring management platform like Tutorbase is built to handle this operational split. It allows you to create distinct profiles and workflows for each worker type, setting fixed availability for employees while letting contractors manage their own schedules. The payroll system handles both employee pay structures and contractor revenue-share models, ensuring your back office remains efficient.

Managing Both Tutors And Contractors In One System

Whether you choose employees, independent contractors, or a hybrid model, your operational software must be able to handle both. Using separate systems for payroll and scheduling creates administrative chaos. A unified platform is essential for maintaining compliance and efficiency.

The right software allows you to manage both worker types from a single dashboard, automatically applying the correct rules. This prevents costly mistakes like miscalculating pay or scheduling a contractor in a way that risks their classification status.

Automating Payroll For Employees

For W-2 employees, payroll involves complex calculations for taxes, overtime, and premiums. A robust tutor payroll software system automates these tasks. In a platform like Tutorbase, you can configure specific pay rules for each employee, including:

- Base Pay Models: Support for hourly, per-lesson, or salaried compensation.

- Variable Premiums: Automatically add extra pay for lessons taught during evenings, weekends, or for specialized subjects.

- Overtime Calculation: Set rules to automatically calculate and apply overtime rates.

This automation reduces a multi-hour manual process to just a few minutes, ensuring accurate and timely payments.

Streamlining Payments For Contractors

Independent contractors require a flexible approach that reinforces their status as separate business entities. Features like self-billing and revenue-sharing are critical for compliance.

For contractors, the system should empower their independence. Features like self-billing invoices, where contractors submit their own payment requests based on completed lessons, reinforce their status as a separate business entity and simplify your accounts payable process.

Tutorbase handles this complexity by allowing you to set up unique payment structures for each contractor, such as a 70% revenue share. The system tracks this automatically, generating clear statements that show exactly how their payment was calculated, which builds trust and maintains compliance.

A Unified People Management System

The key to a successful hybrid model is a central "People Management" module. In Tutorbase, you tag each person as an "Employee" or "Contractor," linking their profile to the correct rules across the entire platform.

Wage data from the U.S. Bureau of Labor Statistics shows contractors often command higher rates, while employee benefits can add 30-40% to labor costs. Tutorbase's payroll system handles this variance effortlessly, from base pay with variables to automated contractor invoices, cutting administrative workload by up to 60%. You can review the official BLS compensation data for more details.

When you schedule a lesson or run payroll, the system automatically knows:

- Which pay model to apply (hourly with overtime vs. revenue share).

- How to handle scheduling (fixed employee shifts vs. flexible contractor availability).

- What financial documents to generate (a payslip vs. a 1099 report).

This integrated approach eliminates the operational headaches of managing a mixed team, allowing you to choose the hiring model that best suits your business strategy.

A Decision Framework For Choosing The Right Model

Deciding between hiring employees and engaging independent contractors is a strategic choice that defines your tutoring business. To make the right decision, you must look beyond a simple cost comparison and ask targeted questions about your operational needs and long-term vision.

Answering these questions will clarify which path aligns with the tutoring center you want to build. The "right" answer depends on your goals for growth, quality control, and legal compliance.

Strategic Questions To Guide Your Decision

Before committing to a model, consider your answers to the following questions. They will highlight the trade-offs between control, flexibility, cost, and risk.

How critical is curriculum standardization? If your brand is built on a specific teaching method, you need the high control of an employee model. If you operate as a marketplace for diverse experts, contractors are a better fit.

What level of scheduling flexibility do you require? If you need tutors to cover specific, high-demand shifts that you dictate, you need employees. If you can build your schedule around the availability tutors provide, a contractor setup is more suitable.

What is your tolerance for legal and compliance risk? Misclassifying a worker is a costly mistake. The employee model is legally straightforward, while the contractor path requires careful management to comply with regulations like the "ABC test."

How important is building a cohesive team culture? Employees can be integrated into your company culture through team meetings and professional development. Contractors operate as separate business entities, making a unified culture more difficult to foster.

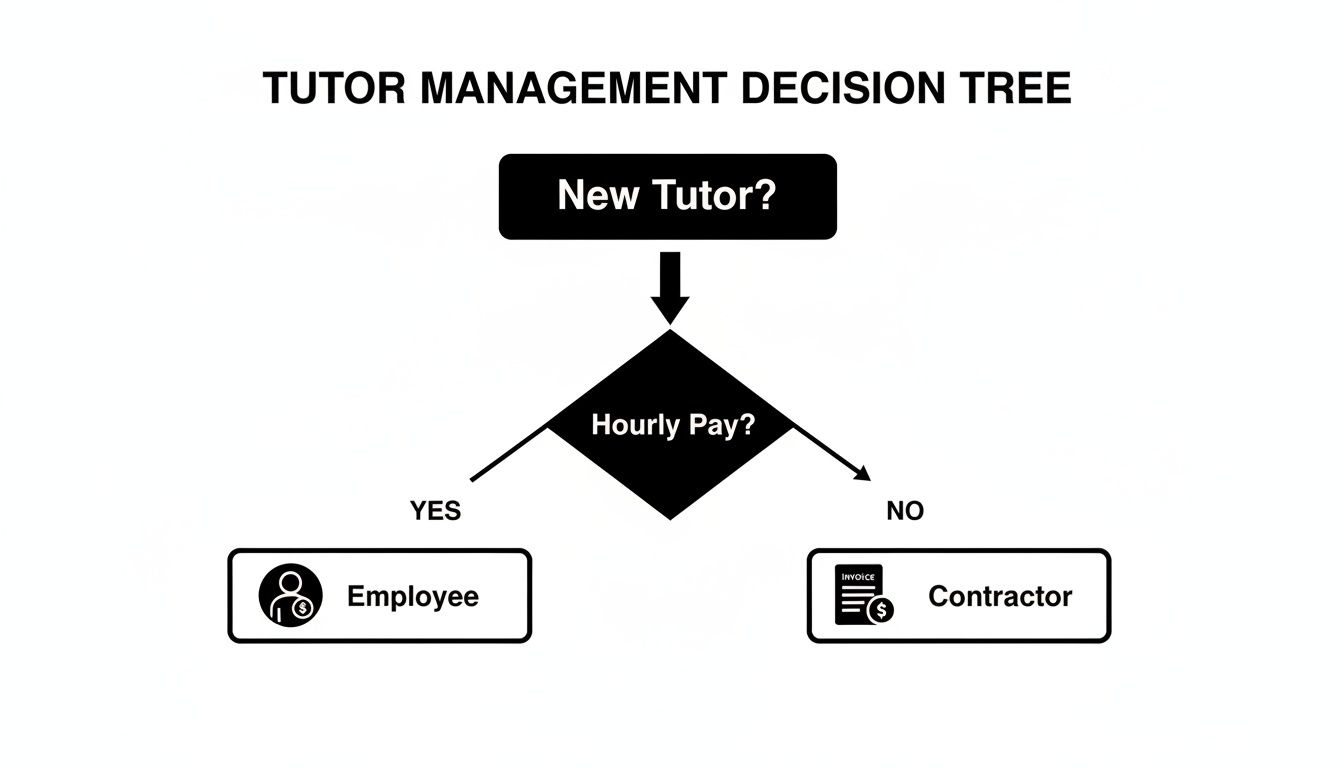

This decision tree helps visualize the core choice: do you prioritize the control of an employee model or the flexibility of a contractor model?

This graphic simplifies the initial decision point. The employee path offers structure through payroll, while the contractor path provides autonomy through invoicing.

Scenarios Where Each Model Excels

To see how this framework applies in the real world, let's examine two common scenarios for tutoring center owners.

The Employee Model is Ideal For: Centers focused on building a consistent brand with standardized teaching methods and a predictable schedule. This is the best path for businesses that require tight control over the student experience.

The Contractor Model is Ideal For: Niche learning centers that need access to highly specialized experts who work with multiple clients. It also suits businesses that function as a marketplace, connecting students with independent tutors.

Ultimately, there is no single "best" answer. The most successful tutoring centers choose a model that supports their unique operational needs and strategic ambitions.

Frequently Asked Questions About Tutor Classification

Can I treat all my tutors as independent contractors to save money?

While classifying everyone as a contractor can seem like a way to reduce payroll costs, this approach is dangerous if it is not legally sound. Regulators use strict tests, such as the "ABC test," to determine a worker's true status based on the level of control you exercise. Misclassification can lead to penalties and back taxes that far exceed any initial savings.

What is the single biggest factor that determines a tutor's status?

The most critical factor is control. If you dictate a tutor's schedule, require them to use your curriculum, and manage their teaching methods, they are almost certainly an employee in the eyes of the law. Genuine independent contractors have significant autonomy over how, when, and where they perform their work.

How does the "ABC test" affect tutoring centers?

The ABC test makes it extremely difficult for most tutoring centers to classify tutors as contractors. To pass, you must prove three things: (A) the tutor is free from your control, (B) their work is outside the usual course of your business, and (C) they operate their own independent tutoring business. Since tutoring is your core business, satisfying part B is a major obstacle that most centers cannot overcome.

Can a tutor be both an employee and a contractor for my center?

This is a legally risky practice and is generally not recommended. Having the same individual perform the same job for the same company under two different classifications is a major red flag for auditors. It undermines any argument that the contractor role is truly separate from your primary business operations.

Does a signed contract protect me from a misclassification claim?

A signed independent contractor agreement is essential, but it is not a guaranteed defense. Your daily operational reality must match the terms of the contract. If your agreement calls a tutor "independent" but you treat them like an employee (by setting their hours or dictating their methods), regulators will prioritize your actions over the written agreement.

Juggling the different payroll rules and scheduling needs for both employees and contractors gets complicated, fast. Tutorbase is built for this. It lets you set unique rules for each tutor type in one system, keeping you compliant and organized. Take the complexity out of your operations by signing up for Tutorbase.