Key Takeaways: Running a tutoring center requires, at a minimum, General Liability insurance to cover physical accidents and Professional Liability (Errors & Omissions) insurance to protect against claims of educational negligence. These policies form the foundation of your risk management, protecting your business from common incidents like slip-and-fall accidents or parent complaints about student outcomes.

What Insurance Does a Tutoring Center Actually Need?

Navigating business insurance can feel overwhelming. For a tutoring center, it boils down to protecting four key areas: your physical location, your professional services, your equipment, and your team. Getting this coverage wrong exposes your business to financial risks that could force you to shut down permanently.

It’s easy to see insurance as just another expense, but it is a critical investment in your center’s stability. A single slip-and-fall accident or one lawsuit from a dissatisfied parent can generate costs far exceeding years of premium payments. With the right policies, you can manage unexpected events without risking the business you've worked so hard to build.

The market for tutoring center insurance reached USD 4.18 billion in 2024, showing how vital this protection has become. General liability is the most common policy because it covers third-party claims for injuries or property damage, making it non-negotiable if students and parents visit your physical location.

The Four Pillars of Tutoring Center Protection

A solid insurance plan for any tutoring center is built on a few essential policies that address the most common and potentially damaging risks you face. For a broader overview, this practical guide to insurance for small business owners is a useful resource.

Let's simplify it by breaking down the foundational coverage every center owner should have in place.

Essential Insurance Coverage for Tutoring Centers at a Glance

This table summarizes the four core insurance policies that form a tutoring center's risk management foundation. Understanding what each policy does is the first step toward building a comprehensive safety net for your operations.

| Insurance Type | What It Covers | Why It Is Essential |

|---|---|---|

| General Liability | Bodily injury or property damage to third parties (students, parents) at your center. | Protects against common accidents like a student tripping over a loose rug or damaging equipment. |

| Professional Liability | Claims of negligence, errors, or omissions in your educational services. | Defends your center if a parent claims your SAT prep failed to deliver promised score improvements. |

| Commercial Property | Damage or loss of your business property (building, computers, furniture) due to events like fire or theft. | Ensures you can replace essential assets and reopen quickly after an unexpected disaster. |

| Workers' Compensation | Medical expenses and lost wages for employees injured on the job. | Required by law in most states if you have employees and protects them and your business from work-related injuries. |

These policies work together to create a complete shield. General Liability handles the physical world of your center, while Professional Liability protects the educational service you provide. Having both demonstrates to parents, partners, and landlords that you run a professional, responsible operation.

Decoding Your Core Insurance Policies

Understanding your core insurance policies is the first step toward building a tutoring center that can withstand any challenge. Each policy is a specialized tool designed to solve a specific problem. Think of them less as expenses and more as essential assets that protect your team, your students, and your bottom line.

Let's break down the most common types of coverage. We'll cut through the jargon with real-world examples to show how each policy works, whether you're running a K-12 academic center or a test prep academy. This clarity is key to meeting your tutoring center insurance requirements confidently.

General Liability: Your Physical Space Shield

General Liability Insurance is often called "slip-and-fall" coverage. It creates a protective bubble around your physical location. This policy handles claims of bodily injury or property damage that happen to third parties, like students or parents, while on your premises.

For example, if a parent slips on a wet floor and requires hospitalization, General Liability covers the medical bills and legal fees. If a student accidentally knocks over a visitor's expensive laptop, this policy steps in to cover the replacement, preventing a simple accident from becoming a financial disaster.

For any business with a physical location where people gather, General Liability is non-negotiable. It is the foundational policy that landlords and partner schools will almost always require before working with you.

Professional Liability: Your Educational Promise Insurance

While General Liability covers physical accidents, Professional Liability Insurance (also known as Errors & Omissions or E&O) protects the educational service you provide. It defends you against claims of negligence, mistakes, or failure to deliver the academic results a client expected.

This coverage is critical for tutoring centers. For instance, if a parent sues your test prep academy, claiming your SAT course did not deliver the promised score improvement, this policy would cover your legal defense costs. It protects your reputation and finances from subjective claims about your teaching quality.

Commercial Property: Your Asset Protection Plan

Your center contains valuable assets, from computers and smartboards to furniture and textbooks. Commercial Property Insurance protects these physical items, and the building itself if you own it, from events like fire, theft, or vandalism.

If a pipe bursts overnight and ruins your classroom furniture and laptops, this policy provides the funds to replace everything. It allows you to get your center back up and running quickly, which minimizes disruption for your students and your staff.

Workers’ Compensation: Your Team Safety Net

If you have employees, Workers’ Compensation is typically a legal requirement. This policy covers medical expenses and a portion of lost wages for any employee who gets injured or becomes ill as a direct result of their job.

For example, if a tutor injures their back while lifting a heavy box of supplies, Workers' Comp pays for their doctor visits and physical therapy. This coverage creates a safer environment for your team and shields your business from costly lawsuits related to on-the-job injuries.

Abuse and Molestation: Your Trust and Safety Policy

For any business working with minors, Abuse and Molestation Insurance is an essential part of your risk management strategy. This policy is designed to cover defense costs and potential settlements that arise from allegations of sexual misconduct or physical abuse.

Having this coverage sends a strong signal to parents that you prioritize student safety. It demonstrates a serious commitment to creating a secure learning environment while providing critical financial protection against devastating, and potentially false, allegations. It is a policy that builds immense trust within your community.

Protecting Your Digital and Mobile Operations

Today, physical accidents are not the only risk you manage. Your tutoring center’s digital operations, including online payments, scheduling software, and student data storage, create new vulnerabilities. Ignoring these modern insurance needs is a significant gamble.

This is where specialized policies become crucial. They are built for the realities of hybrid classes, online data, and off-site activities, ensuring your business is covered from every angle. Let's break down the key policies that protect your modern operational footprint.

Why Cyber Liability Insurance Is Non-Negotiable

If you use any student management software, process online payments, or store sensitive family information, Cyber Liability Insurance is essential. This policy is your digital disaster recovery plan, designed to cover the costs associated with data breaches, hacking, and other cybercrimes that can destroy your operations and reputation.

These risks are more common than many owners believe. In 2023, educational institutions were hit with 2,365 data hacks impacting 3.43 million victims. A single convincing phishing email is all it takes to compromise your student database, leading to enormous recovery costs and fines under privacy laws like GDPR or CCPA.

This policy helps pay for:

- Notifying all affected parents and students.

- Credit monitoring services for the victims.

- PR campaigns to manage your reputation.

- Legal fees and any regulatory fines.

Covering Your Center on the Move

Does your business own any vehicles for transporting students or for staff travel between locations? If so, a personal auto policy will not cover accidents that occur during business hours. For that, you need Commercial Auto Insurance.

This coverage protects you from liability for bodily injury or property damage caused by company-owned vehicles. It ensures a fender bender during work hours does not put your entire business’s assets at risk. It's a critical piece for any center offering mobile or transportation services.

A business interruption policy is designed to replace lost income and cover ongoing expenses like payroll and rent if your center has to temporarily close due to a covered event like a fire or major flood. It’s the policy that keeps your business financially stable while you recover.

Protecting Your Revenue with Business Interruption Coverage

Imagine a fire forces your tutoring center to shut down for weeks. Even though you are not teaching, the bills continue, your rent, tutor salaries, and other operating costs are still due. Business Interruption Insurance is the safety net that covers this lost income and helps you manage expenses during that downtime.

This policy is often bundled with Commercial Property insurance and is vital for staying afloat. It provides the cash flow needed to survive a temporary closure, letting you reopen without accumulating massive debt. It is a core part of any resilient business strategy.

Meeting Landlord and Partner Insurance Requirements

Your insurance decisions often involve third parties. If you plan to sign a lease or partner with a school, they will have their own tutoring center insurance requirements you must meet. This is a standard part of doing business designed to protect everyone involved.

For example, a commercial lease agreement will almost always require you to carry general liability coverage, typically with a minimum of $1 million per occurrence and $2 million in aggregate. Landlords require this so that if an accident happens on their property, your policy is the first line of defense.

The same applies to school districts and community venues. Many now insist that outside tutors carry liability insurance before they are allowed on campus. This has become a non-negotiable standard, and many venues will refuse to rent space to uninsured programs, halting your expansion plans.

Understanding the "Additional Insured" Request

A common term you will encounter is "additional insured." Landlords and partners will ask to be added to your policy via an additional insured endorsement. This is a very common request.

This endorsement simply extends your liability coverage to them. If a lawsuit arises from an incident at your center and names both you and your landlord, your insurance policy defends them, too. It does not give them control over your policy; it just offers them protection related to your business operations.

Being asked to add a landlord or partner school as an additional insured is a routine and legitimate request. It's a key part of building trust and formalizing a professional relationship, demonstrating that you are prepared to manage your own operational risks responsibly.

How to Prepare for Partner Requirements

The key is preparation. Before you sign any lease or partnership agreement, discuss their insurance needs directly. Trying to manage different requirements for multiple locations can become chaotic, which is why a centralized platform like tutoring center software is helpful for tracking these details in one place.

You will need to provide a Certificate of Insurance (COI). This is a standard, one-page document from your insurer that summarizes your coverage, including policy limits, effective dates, and any additional insureds. It is the proof you need to satisfy landlords and partners, allowing you to expand into new locations confidently.

Creating Your Tutor and Staff Insurance Checklist

Building a secure tutoring center requires a solid onboarding process that goes beyond contracts and background checks. You need a systematic way to verify insurance for everyone who works for you, especially independent contractors. Skipping this step leaves your business exposed to serious financial risk.

Your first step should always be to request a Certificate of Insurance (COI) from every 1099 contractor. This is not the policy itself, but a one-page document that serves as official proof of their coverage. It provides a quick snapshot of their policy type, coverage limits, and expiration date.

Once you receive the COI, review it carefully. Ensure the policy is active and the coverage limits meet your center's minimums, which is often $1 million in professional liability. Most importantly, confirm that your tutoring center is named as an "additional insured." This is critical because it extends their policy's protection to your business for the work they perform.

How do I handle insurance for employees vs. contractors?

The liability difference between W-2 employees and 1099 contractors is significant. Your insurance responsibilities change completely based on how you classify your team. This distinction affects workers' compensation and payroll, processes you can automate with the right tutor payroll software.

Use this checklist to manage the key insurance differences.

Employee vs. Independent Contractor Insurance Checklist

| Consideration | W-2 Employee | 1099 Independent Contractor |

|---|---|---|

| Workers' Compensation | Your center must provide this coverage as required by law in most states and provinces. | The contractor is responsible for their own coverage. You should request proof that they have it. |

| Liability Insurance | They are covered under your center's general and professional liability policies. | They must carry their own policies, and your center must be named as an "additional insured." |

| Verification Process | Internal process. Ensure they are properly included in your company-wide policies. | Formal process. You must request their COI, check the limits, and confirm "additional insured" status. |

Part of protecting your team is knowing local laws. For instance, businesses with employees in Ontario must understand their obligations for WSIB insurance in Ontario to cover workplace injuries. This is a perfect example of how regional regulations add another layer to your compliance checklist.

Make insurance verification a non-negotiable step in your onboarding. Think of it as a powerful shield against unforeseen claims. A clear, consistent checklist for both employees and contractors isn't just paperwork—it's one of the smartest operational decisions you can make.

Frequently Asked Questions About Tutoring Center Insurance

Let's address the most common questions from tutoring center owners. These details often cause the most confusion, so we'll provide direct answers to help you protect your business confidently.

How Much Does Tutoring Center Insurance Cost?

The cost of tutoring center insurance varies, but most small to mid-sized centers should budget between $400 to over $1,500 per year for a Business Owner's Policy (BOP). A BOP typically bundles General Liability and Commercial Property coverage.

Several factors influence your premium:

- Location: Operating in a high-rent district or a litigious state increases costs.

- Number of Students: More students means more potential risk, which leads to a higher premium.

- Services Offered: High-stakes test prep for the SAT is considered higher risk than elementary math tutoring, which can increase your professional liability costs.

- Claims History: A history of claims will cause your rates to increase.

Does an Online-Only Tutoring Center Still Need Insurance?

Yes. While you may not have risks associated with a physical location, your digital and professional risks are still very real.

Professional Liability (E&O) is non-negotiable to protect you if a parent claims your methods were ineffective. In 2024, Cyber Liability is just as crucial to cover you in case of a data breach involving student records or payment details. Your core business is education, which always comes with professional risk.

How Do I Choose the Right Insurance Provider?

Finding the right provider is about finding a partner who understands educational businesses, not just the cheapest quote. An experienced agent knows the unique claims that arise and understands why coverages like abuse and molestation are so important.

When comparing providers, ask them, "How many other tutoring centers do you work with?" A great agent does not just sell you a policy; they help you identify risks you may have overlooked.

A great insurance agent does more than sell you a policy. They act as a risk management partner, helping you understand your exposures and ensuring your coverage evolves as your tutoring center grows.

How Often Should I Review My Insurance Policies?

Review your policies with your agent at least once a year. Think of it as an annual check-up for your business's financial health. However, you should not wait for the annual review if a significant change occurs.

Contact your agent immediately if you are:

- Opening a new location.

- Experiencing a significant increase in student or staff numbers.

- Adding new services, like online programs.

- Purchasing expensive new equipment, like new laptops or smartboards.

Keeping your policy aligned with your operations ensures you are not underinsured when you need coverage the most.

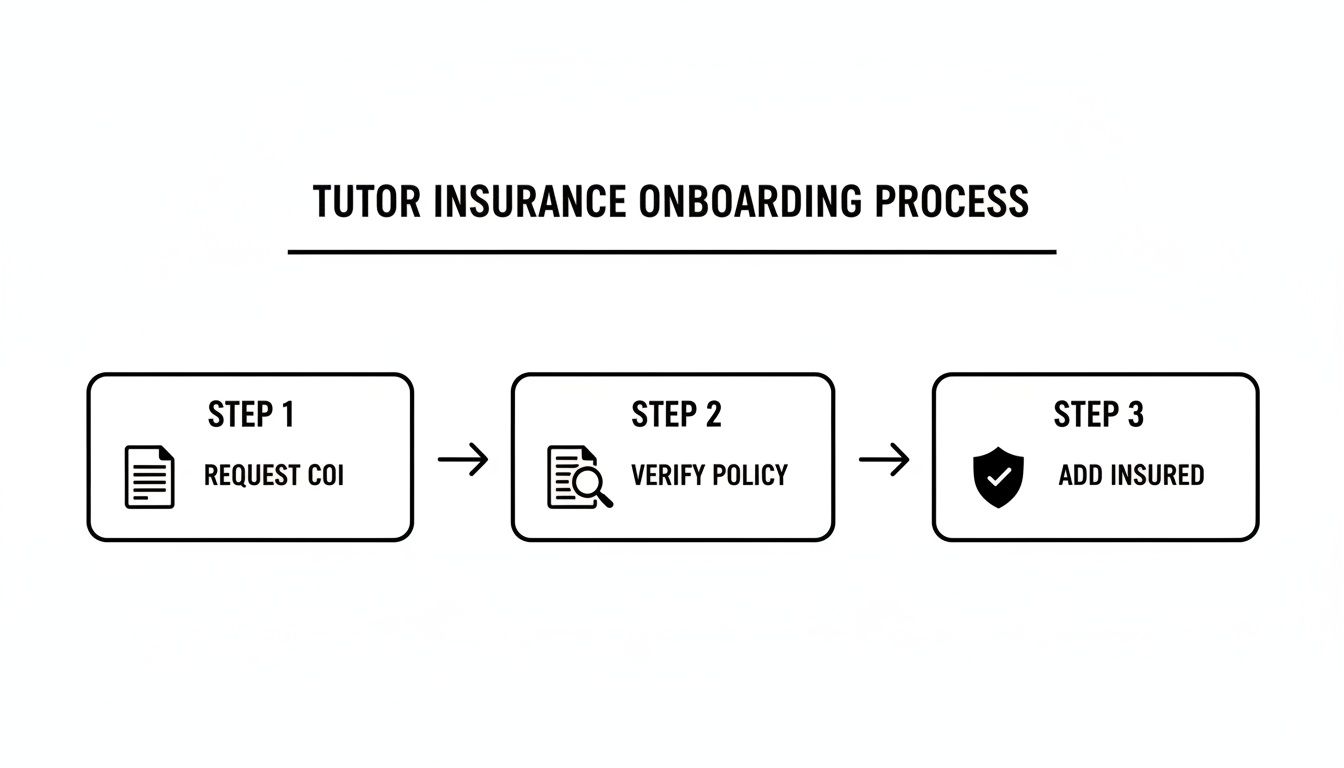

When you bring on contractors, a simple, repeatable process is necessary to verify their insurance. It involves three key steps.

Following a standardized procedure like this ensures every contractor is properly covered, which is critical for protecting your center from claims that arise from their work.

Managing risk is just one part of running a successful tutoring center. To reduce admin time by 60% and eliminate booking errors, see how Tutorbase consolidates scheduling, billing, and payroll into one smart platform. Get started for free.